New energy, no more?

In the bumper year of new energy vehicles, Musk lost his title as the richest man, Tesla's market value fell below, and was surpassed by the oil giant ExxonMobil. BYD, whose annual sales soared by more than 1.5 million yuan, can only maintain its share price. Not only did it not have the surge expected by capital, but it was also sold off six times in half a year by Buffett, reducing his holdings by more than 1/5.

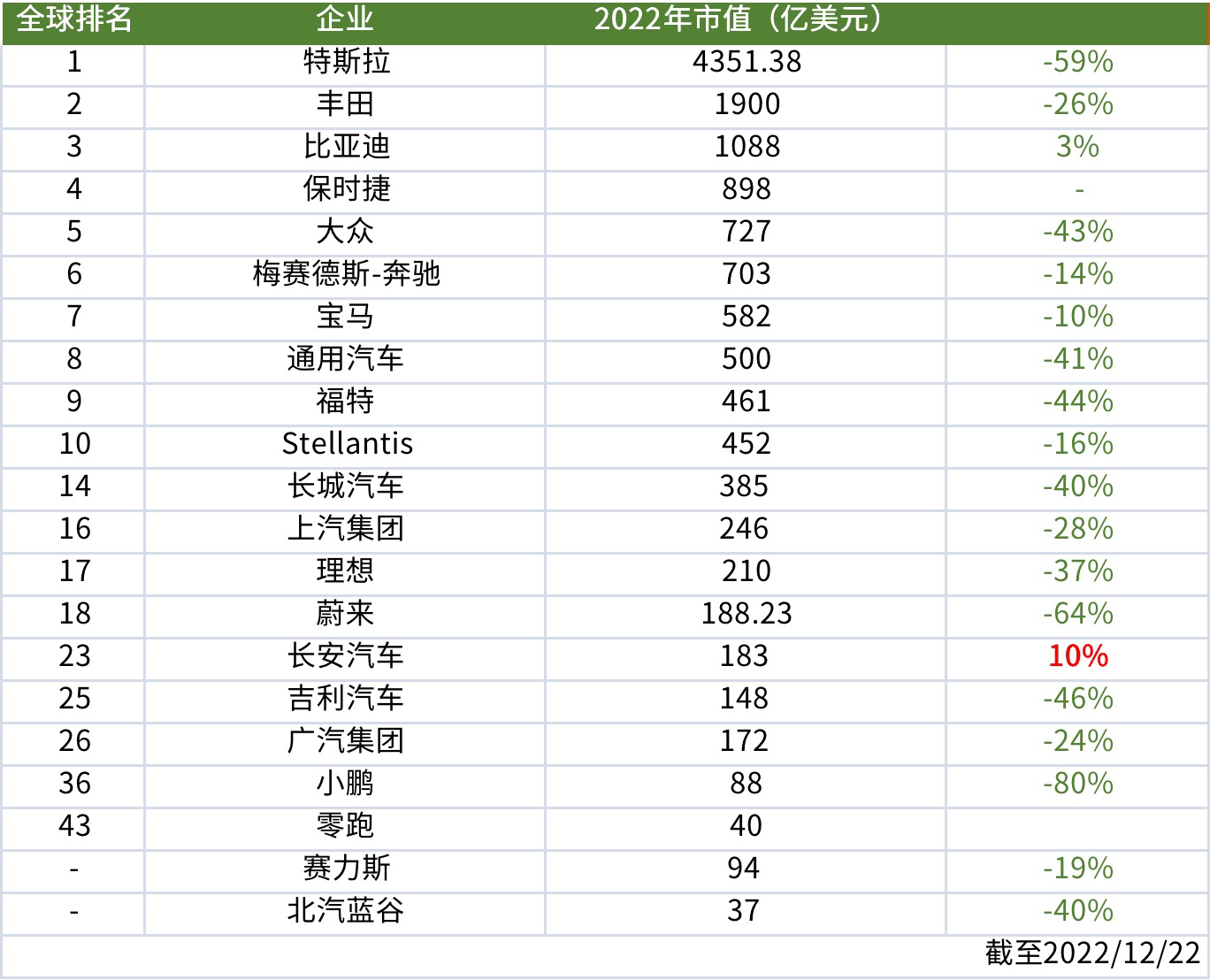

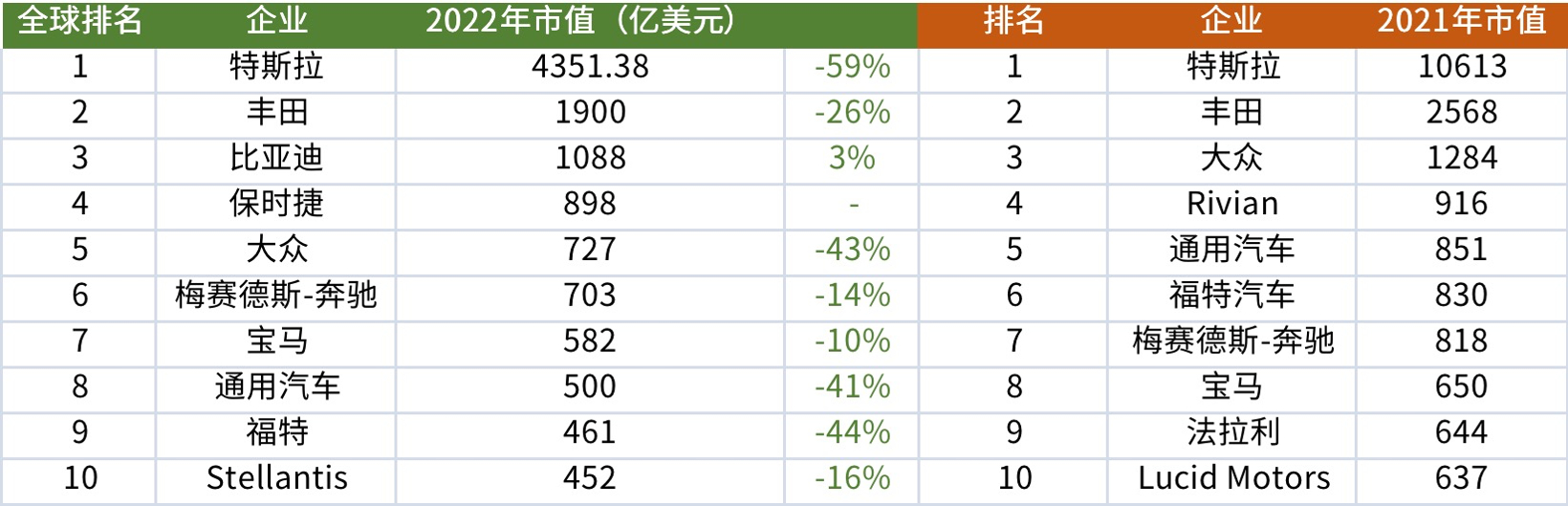

According to the statistics of Phoenix Auto, the market value of the 21 core vehicle manufacturers has dropped by 61% in 2022 on average as of the date of publication. The Hurun Research Institute also showed that the overall value of global auto enterprises fell by 21% due to the impact of the epidemic.

For Chinese auto companies, the "dark moment" is even more fierce. With the correction of the value of new energy stocks, Great Wall and Weilai fell out of the list of the world's top 500, and the market value of Chinese brands dropped by more than 80%.

Why can't the new energy vehicle, known as the golden track, afford to overestimate?

Tesla is worried about the collapse of new American cars?

In the past two years, Tesla has been famous on Wall Street for its "hard work", but its market value will fall by 60% in 2022.

The core reason is that Tesla's growth rate is lower than expected.

Musk previously said that he hoped Tesla would achieve an average annual delivery growth rate of more than 50% in the next few years. This means that the delivery target will reach 1.4 million in 2022. Its sales volume in the first three quarters was 908000 units, with a completion rate of 61%. In addition to the news that Tesla's Shanghai factory has repeatedly reported production cuts, this year's "KPI" may be worrying.

In order to promote sales growth, Tesla China has reduced prices directly or in disguised form for three times in the past four months, with a maximum comprehensive discount of 50000 yuan. However, the demand continues to decline, and the delivery cycle of Model 3 and Model Y is further shortened, which only takes 1-2 weeks at present.

CITIC Securities believes that, considering Tesla's gross profit margin of nearly 30% on vehicle sales, and conservatively estimating that Tesla's sales will exceed 3 million vehicles in 2025, it is expected to achieve a profit of $24 billion to $30 billion, which can only support the company's valuation of about $500 billion, less than half of the company's heyday.

Analysts from Evercore ISI said that weak demand may cause Wall Street to shift its attention from Tesla's growth to profitability, which may further reduce the valuation.

The other two new American cars, the Rivian and Lucid, which are known as "Tesla Killers", have all fallen out of the top ten and their market value has evaporated seriously.

First of all, Lucid is in the predicament of losing money for consecutive years. Its market value has shrunk from 60 billion to 12 billion, ranking 29th in the world. From 2019 to 2021, the accumulated loss of the Company has reached 3.5 billion US dollars (equivalent to about 23 billion yuan). By the end of 2021, Lucid had only sold 125 vehicles and 1039 vehicles in the first half of 2022.

However, Rivian's situation is not optimistic, and its market value has plummeted from 100 billion yuan to 19.3 billion yuan. It dropped from the third highest global ranking to 21. In October, almost all vehicles delivered were recalled because "the fasteners connecting the front upper control arm and the steering knuckle may not be" fully tightened ".

When the capital "subsided", the value foam of the new forces was punctured. If the company fails to produce the performance that supports the market value in the future, I'm afraid its share price will fall further.

"Di Wang" eats meat, younger brother drinks soup?

Behind the frustration of the New American Department, there is a bigger winner - BYD.

Among the Hurun Global 500, BYD has the best performance among Chinese auto companies. Benefiting from the popularity of new energy vehicles this year, the company's ranking has risen significantly by 31 places, with a total ranking of 127, ranking 10th among all listed enterprises in China.

At present, BYD's market value is about US $108.8 billion. In June, its market value once exceeded one trillion, and its monthly sales volume broke from 100000 to more than 400000, with a soaring trend.

But now, the market value of BYD, which has been awarded the title of "Di Wang", is not optimistic, rising only 3% year on year, and dropping nearly 30% compared with the peak period.

Some analysts pointed out that the decline of BYD's market value was also related to the market panic caused by Buffett's selling. Since the second half of 2022, Buffett has sold BYD shares for 6 times, reducing his holdings by more than 1/5.

As early as 2008, after Buffett subscribed to BYD shares on a large scale, its share price has doubled 10 times in one year. Wang Chuanfu's value soared to 35 billion yuan in 2009, becoming the richest person on Hurun's rich list. Today, BYD's market value has increased more than seven times. Buffett's insistence may cause some capital to doubt whether BYD's market value has peaked.

However, in any case, the benefits brought by the new energy concept still make many traditional car enterprises "jealous". When the stock price of the parent company is in the period of callback, splitting its new energy brand has become a new trend for automobile enterprises.

At the beginning of 2022, Chang'an New Energy disclosed at the signing ceremony of round B financing that it planned to complete its public listing around 2025. In addition, Avita, its high-end brand, has plans to go public independently in the future. Avita is an intelligent automobile enterprise jointly built by Changan Automobile, Huawei and Ningde Times.

In October, GAC Aian completed a round A financing with a total amount of 18.294 billion yuan. GAC E'an said that the completion of round A financing will accelerate the business development of GAC E'an, and will further strengthen its ability to face the capital market, go public at the right time, and build the first share of the new energy vehicle brand innovation board.

In November, Landau announced that it had completed round A financing of nearly 5 billion yuan, and the market value of Landau after financing was nearly 30 billion yuan. Shen Jun, chief financial officer of Lando Automobile, said that Lando would continue to carry out subsequent rounds of financing at the right time and consider the subsequent IPO plan based on the comprehensive market and regulatory policies.

In December, Geely's high-end brand Krypton Automobile reported that it had submitted IPO related documents to the US regulatory authorities, and planned to raise $1 billion. The specific time for listing has not been determined. The insiders also revealed that the valuation of Krypton Automobile would exceed 10 billion dollars. In addition, Jixing brand and Yikatong also landed on NASDAQ this year.

The separate listing of sub brands can attract the market in a more vertical way and enhance the popularity and brand effect of sub brand users. In addition, it has got rid of the shackles of traditional systems and structures, and has more independent rights, which is conducive to improving operational efficiency and innovation capabilities.

Traditional tycoons are under great pressure

For the rise of new energy, the most urgent thing is the "rich men" in the old energy era.

This year, the ranking of Toyota Motor, the world's second largest car company, has not changed, but Akio Toyoda, the leader, is obviously "anxious" about the electrification transformation. Recently, he once again expressed doubts about the overall electrification, revealing the dissatisfaction of the industry with the All in electric car. Mr Toyoda said he was "one of the silent majority" in the auto industry.

As early as 2020, Akio Toyoda publicly said that pure electric vehicles were "over hyped" and claimed that electric vehicles need huge investment and emit more carbon dioxide. In his view, hybrid vehicles should also be promoted as long as energy conservation and emission reduction can be achieved.

Previously, he pointed out sharply that Tesla's market value was seriously overestimated, and that "Toyota's large-scale manufacturing is the security backing." If you use the analogy of running a restaurant, Akio Toyoda thinks Tesla only has "recipes", but Toyota has "kitchens and chefs", which can make real "food".

By October 2022, Toyota had only sold 14400 pure electric vehicles worldwide, and the transformation progress was not as expected by the market.

The fourth largest auto company in the world in terms of market value is Porsche, which just hit the IPO in 2022. Investors' demand for the IPO of Porsche was very strong, even exceeding the total issuance of Porsche. Porsche's market value exceeded that of its parent company Volkswagen Group one week after its listing.

After paying dividends with the proceeds of Porsche's IPO, Volkswagen announced that the remaining funds would be used for electric vehicle transformation and software investment. It is reported that it gained nearly 100 billion yuan from the sale of preferred shares. It can be seen that Porsche has provided strong financial support for Volkswagen's electrification transformation after expanding its financing channels.

The independent IPO of top luxury cars may become a trend in 2023. It is estimated that the IPO of Lamborghini may start in the next 18 months. Considering the operating profit margin data, it is reasonable that its valuation reaches 16 billion dollars or more.

Weixiaoli is further away from the "altar"

In 2023, Weixiaoli will be further away from the "altar". In the general environment, it is the pressure on the valuation of growth stocks and the excessive interest rate increase in the United States that caused the collective "avalanche" of China probability stocks.

On the other hand, the high cost of electric vehicles, the US Inflation Reduction Act and the slowdown of sales growth of the brand itself have cast a shadow on the prospects of former top students.

On the market side, the sales volume of most new forces is far from the target at the beginning of the year. Take "Weixiaoli" as an example. Its annual sales targets are 150000, 250000 and 200000 respectively. As of November, the total sales were only 106700, 109500 and 112000, with the completion rate of 71%, 44% and 56%.

In terms of income, the new forces are still in a loss state.

The ideal benefit is that the gross profit loss of single car is the least, but the expenses and R&D costs have no scale effect; Xiaopeng has seen the scale effect for the first time, showing a trend of "hemostasis". However, due to the low gross profit, the bicycle loss is still high. However, Weilai is difficult to make profits in the short term due to the launch of the three brand strategy and the high R&D investment in new cars.

The window period is closed and the competition is extremely fierce. From the sales volume of the previous three quarters, traditional car companies are catching up. According to the data of CCCC, among the top three, BYD and SAIC GM Wuling are traditional car companies, while Tesla China ranks third. Among the new forces such as Weixiaoli, only Xiaopeng Automobile entered the top ten in sales volume. At the same time, the second tier teams such as Nezha and Zero Run have developed rapidly, and have become the first tier team in terms of number.

At the same time, the price of "Weixiaoli" is generally higher than 200000 yuan, which is no longer the fastest growing segment.

According to November data released by China Automobile Association, the selling price of 100000 to 250000 yuan in the market accounts for 57.8% of the overall market share. However, the selling price above 400000 is very limited, accounting for only 5.5% of the overall market. The annual sales volume is below 150000 units.

It may be the main theme of the new forces in 2023 to delay rising and sinking.

How far is it?

With the full release of the domestic market, the capital's expectation of the new energy vehicle market is further improved. In 2022, the sales volume of new energy vehicles will exceed 6 million, exceeding the expectation at the beginning of the year. According to the analysis of many institutions, it is estimated that the domestic sales volume is expected to reach 6.8 million units this year and 9 to 9.5 million units in 2023.

China Automobile Association is expected to have 9 million vehicles, while Cui Dongshu, the secretary-general of the Passenger Transport Association, predicted that the sales volume of new energy vehicles in China would reach 8.4 million in the coming year, with a year-on-year growth of about 30% expected by the market.

Taking Ping An Securities as an example, the agency believes that the sales volume of passenger cars is 9.05 million, with a year-on-year increase of 39.2% and a penetration rate of 40%. The growth core comes from the Northeast and North China regions, the third, fourth and fifth tier sinking markets and non restricted purchase regions.

Cui Dongshu said: "With a high penetration rate of 36% in November this year, the new energy vehicle market has entered a super market driven stage."

Looking forward to the enterprises, BYD and Tesla will still lead the way. The traditional independent car enterprises are expected to increase their production rapidly. The new force of car building is expected to reach 200000 units by 2023, and some new forces will reach 300000 units.

In terms of vehicle models, the sales of low-cost electric vehicles below 100000 yuan will remain unchanged. The mass market of 100000 yuan to 200000 yuan will see a high growth of more than 1.5 million units, while the growth of 200000 yuan to 300000 yuan will be about 850000 units, and the growth of more than 300000 yuan will be about 40 units.

At the same time, plug-in hybrid vehicles will become the largest growth momentum of new energy vehicles in 2023, and the growth of pure electric vehicles is expected to mainly come from the market of more than 200000 yuan. The plug-in hybrid models of BYD, Geely, Great Wall and Chang'an are expected to increase rapidly and occupy a certain market share in the mainstream price belt. At the same time, Ideals and Huawei AITO are expected to dominate the high-end plug-in market.

In the future, the scale advantage of traditional automobile enterprises will be gradually released. Geely, Great Wall and Chang'an are expected to become the second echelon of new energy vehicles. The agency warned that vehicle manufacturers should be alert to the high cost and price of power batteries, and that key components such as chips may still be in short supply. The adverse factors on the supply side may still cause the penetration rate of new energy vehicles to be lower than expected.

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Bridgestone exits Russia and sells assets to S8 Capital

Live Up to Expectations and Honor to End | 2023 Wenzhou International Auto Parts Exhibition Successfully Ends! Looking forward to meeting you in 2024!

Received nearly 140 million yuan in intended orders! Ruian New Energy and Intelligent Connected Vehicle Parts Exhibition Successfully Ends

Free support line!

Email Support!

Working Days/Hours!