The phenomenon of "price war" that arose on a large scale after 1949 has made the fuel vehicle camp hot again. It seems that they are about to usher in a new round of counterattack against new energy vehicles in this market environment with multiple barriers in four suburbs.

Recently, a news of upstream raw materials came, as if to "kill" this grand occasion of fuel vehicles.

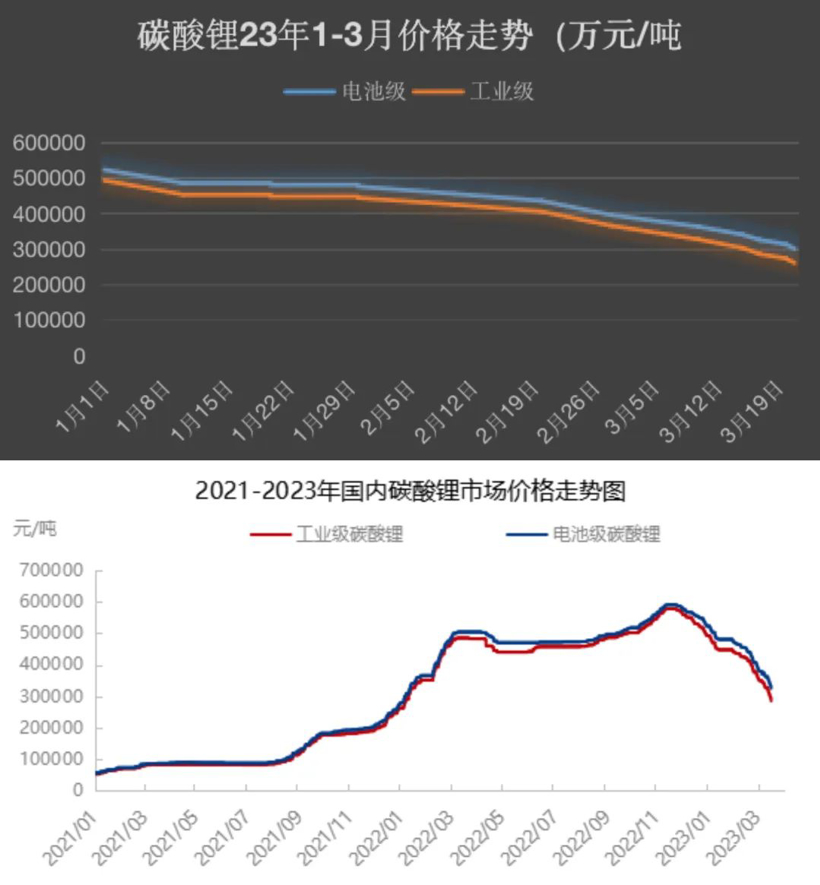

According to reports, the price of lithium carbonate, a raw material for batteries, has fallen sharply. Among them, battery grade lithium carbonate fell below 300000 yuan/ton, reaching a minimum of 280000 yuan/ton and a maximum of 320000 yuan/ton. Compared to the highest price of 517500 yuan/ton this year, the decline was nearly 40%, while compared to the historical peak of 600000 yuan/ton in the past two years, the decline reached 50%, equivalent to cutting back. As of the 23rd of this month, the price of lithium carbonate has dropped to 280000 yuan/ton, with a minimum of 260000 yuan/ton.

In fact, looking at the price list over the past period of time, it is not difficult to find that the price of battery grade lithium carbonate has been declining all the way since this year, even experiencing a collapse.

There is news that the selling of lithium carbonate in the market is still continuing, and downstream customers are afraid to place large orders, resulting in a serious wait-and-see mood; On the other hand, there has also been a phenomenon of lithium carbonate chargebacks in the overseas market... Under the impact of both front and back, the price of battery grade lithium carbonate may encounter even worse situations in the future.

Of course, the reason why the price of lithium carbonate has attracted much attention is that as one of the raw materials for power batteries of new energy vehicles, the price of lithium carbonate to some extent determines the price of new energy vehicles in the new year. Professionals speculate that every adjustment of 100000 yuan/ton of lithium carbonate will affect the cost price of 3000 yuan per new energy vehicle.

Lithium carbonate dominates the battery market

According to the current pattern of new energy batteries, power batteries are roughly divided into two factions. One faction is a lithium iron phosphate battery using lithium carbonate as raw material, and the other faction is a ternary lithium battery using nickel cobalt manganese as raw material.

On March 10th, the data released by the China Automotive Power Battery Industry Innovation Alliance showed that in February this year, China's power battery loading volume was 21.9GWh, a year-on-year increase of 60.4%, and a month-on-month increase of 36.0%. Among them, the installed capacity of ternary lithium batteries was 6.7GWh, accounting for 30.6% of the total installed capacity, with a year-on-year increase of 15.0%; The load of lithium iron phosphate batteries was 15.2GWh, accounting for 69.3% of the total load, with a year-on-year increase of 95.3%.

From the above data, it can be seen that the installed volume of lithium iron phosphate batteries in the current month has accounted for nearly 70% of the total installed volume, basically reversing the situation in which ternary lithium batteries dominated new energy vehicles in the past, with lithium carbonate playing a significant role.

The reason is nothing but high cost performance.

It is no exaggeration to say that, as the two open-circuit carriages in the field of new energy vehicle power batteries at this stage, the love and hatred between lithium ternary batteries and lithium iron phosphate batteries can be written in three lifetimes.

Firstly, both batteries use graphene as the negative electrode material. Among them, lithium iron phosphate batteries use lithium iron phosphate made from lithium carbonate as the positive electrode, while ternary lithium batteries mainly use composite materials made from nickel cobalt manganese as the positive electrode. It is also the difference in cathode materials that determines the completely different performance of these two types of batteries.

In the past, the industry generally favored lithium ternary batteries because their energy density was much higher than that of lithium iron phosphate batteries, which meant that for two types of batteries with the same volume, the endurance of lithium ternary batteries was almost twice that of lithium iron phosphate batteries. Even though the service life and safety of a lithium iron phosphate battery are lower than that of a lithium iron phosphate battery, the double kill of its endurance alone can make it completely impossible for a lithium iron phosphate battery to turn over.

However, the long-term existence of a monopoly is a "hotbed" of market price disorder.

As the market share of ternary lithium batteries gradually increased, reaching nearly 90% in 2019, the price of raw materials nickel, cobalt, and manganese also increased. In particular, the domestic production of the rare metal nickel and cobalt is not high, and it is heavily dependent on imports. Under such dual factors, the cost price of ternary lithium batteries continues to rise, reaching the limit that automotive companies can bear.

Also at this time, there has been a revolution in the technology of lithium iron phosphate batteries, especially the lithium iron phosphate blade battery developed and produced by BYD, which largely solves the problem of low energy density of lithium iron phosphate batteries and helps them gradually regain their lost market share.

Therefore, as the loading capacity of lithium iron phosphate batteries steadily increases, the raw material lithium carbonate has become a "sweet cake".

Lithium carbonate mainly comes from lithium mines, and some comes from brine extraction. Its cost is far lower than nickel and cobalt, and its domestic production is also sufficient. It soon became a new barrier to curb the cost of new energy vehicles.

Last year, the price of lithium carbonate reached its peak. In order to control this momentum and prevent it from becoming the second nickel cobalt producer, the Ministry of Industry and Information Technology issued an official document last year, pointing out that the periodic imbalance between supply and demand in the domestic lithium battery industry chain is serious, with hoarding and unfair competition occurring in some fields. To ensure the coordination and stability of the lithium battery industry chain supply chain, it is necessary to appropriately expand the production scale, optimize the industrial regional layout, strictly investigate and deal with the hoarding and price raising in the upstream and downstream of the lithium battery industry Maintain market order through unfair competition and other activities.

Can the fuel truck persist

A lesson from the past, a teacher from the future. With further market regulation, results have been achieved since the beginning of this year - lithium carbonate prices have finally fallen, albeit at a faster pace, similar to jumping off a building.

The reason for this should also be related to the decline in the demand for new energy vehicles. At the beginning of the Spring Festival, the smoke in the new energy vehicle market is not yet strong, the number of cars sold is less, and the natural need for raw materials is also less.

For the new car building forces, they must respond as quickly as possible to grasp this wave of price cuts, which is a welcome good thing for consumers. It seems that the good days of equal prices for oil and electricity are not far away.

The fundamental reason for this price value change is that in the era of fuel vehicles, the engine is the key, while in the era of electric vehicles, the battery is the key.

Tesla, a pioneer in electric vehicles, said after experiencing a wave of price cuts at the beginning of the year: Tesla can still lower its prices. On the "Tesla Battery Day" in September 2020, Tesla announced a 4680 battery and announced a 5-fold increase in energy density, a 16% increase in range, and a 14% reduction in cost.

This seemingly cost-effective battery has recently ushered in a technological breakthrough. The Fremont factory in California has produced 868000 large cylindrical lithium ion battery cells, capable of supporting 1000 Model Y vehicles. Although there is still some distance to full-scale production, once successful, Tesla's costs can be reduced by another 54%.

On March 21, this year, Ningde Times announced that the company's flagship technology, the Kirin battery, has achieved mass production.

As a product of "benchmarking" BYD blade batteries and Tesla 4680 batteries, Ningde Times stated that the volume utilization rate of Kirin batteries has exceeded 72%, which can increase the energy density of the ternary battery system to 255Wh/kg. At the same time, it is also commonly used in lithium iron phosphate batteries, which can increase their energy density to 160Wh/kg. This can be seen as a comprehensive improvement around the safety, service life, fast charging performance, and energy density of the previous generation of batteries.

Under the attack of two powerful rivals, BYD's blade battery should also be vigorously developing a new generation of products. In early 2022, BYD bought a lithium mining right in Chile, presumably to prepare for it. Coincidentally, major automotive companies, including Weilai, Geely, and Volkswagen Group, are starting to establish their own battery factories.

The current collapse in the price order of lithium carbonate provides an opportunity to clear the obstacles for further price reductions of new energy vehicles. This is also the least desirable aspect of the fuel truck camp. After all, competing at the same price, considering the oil price and configuration, the advantages of fuel vehicles have disappeared. Therefore, it can be said that the decline in the price of lithium carbonate has killed this wave of counterattack on fuel vehicles.

Of course, whether it's lithium iron phosphate batteries or lithium ternary batteries, as the heart of new energy vehicles, their every move always affects the fluctuations of the entire new energy vehicle market. When fuel vehicles, led by the Dongfeng system, are reeling from the deadlock in the price war, it remains to be seen whether new energy vehicles can take advantage of the falling price of lithium carbonate to achieve further success.

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Bridgestone exits Russia and sells assets to S8 Capital

Live Up to Expectations and Honor to End | 2023 Wenzhou International Auto Parts Exhibition Successfully Ends! Looking forward to meeting you in 2024!

Received nearly 140 million yuan in intended orders! Ruian New Energy and Intelligent Connected Vehicle Parts Exhibition Successfully Ends

Free support line!

Email Support!

Working Days/Hours!