In the first half of the year, the performance maintained rapid growth, and the power battery leader Ningde Times delivered a satisfactory answer to the market.

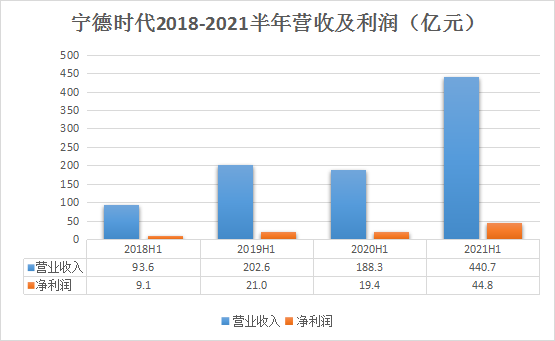

Semi-annual report data shows that CATL achieved revenue of 44.07 billion yuan, a year-on-year increase of 134.1%; net profit attributable to shareholders of listed companies was 4.48 billion yuan, a year-on-year increase of 131.5%.

Resuming the data report for the past three and a half years, except for the impact of the epidemic in the first half of 2020, revenue and net profit have declined slightly, and the overall rise has been stepped up, and the revenue of H1 in 2021 is close to 90% of the full-year revenue of 2020. . According to market feedback, since the second half of the CATL, the production line is still running at full capacity to maintain full production, and the annual growth rate is expected to further increase.

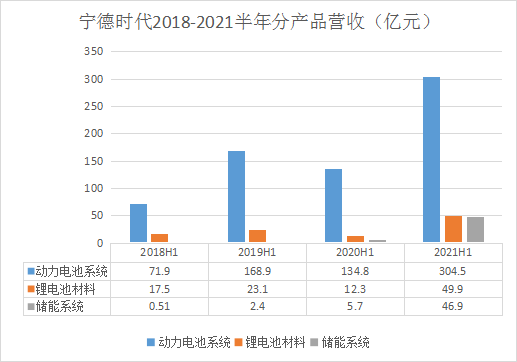

In terms of products, the global new energy vehicle and energy storage industries have resonated and become the core engine driving the performance growth of the Ningde era. Among them, the power battery system H1 achieved revenue of 30.45 billion yuan, a year-on-year increase of 125.9%; the energy storage system achieved revenue of 4.69 billion yuan, a year-on-year increase of 727.4%.

On the power battery side, statistics from the Advanced Industrial Research Institute (GGII) "Global Power Battery Installed Volume Database" show that the global sales of new energy vehicles in the first half of 2021 is approximately 2.252 million, an increase of 151% year-on-year; the installed capacity of power batteries is approximately 100.49GWh, year-on-year An increase of 141%.

Among them, CATL achieved 25.73GWh of power battery installed capacity in the first half of the year, and its market share continued to remain at about 26%, continuing to rank first in the global power battery installed capacity list.

On the energy storage side, as the demand for energy storage on the power generation side and the grid side in the global market grows, CATL has shipped a number of 100MWh-level projects in the first half of the year, and has established long-term strategic partnerships with many domestic and foreign customers. A sharp jump.

At the same time, the recycling of resources such as nickel, cobalt, manganese and lithium through the recycling of waste lithium batteries has also brought nearly 5 billion yuan in revenue to the Ningde era.

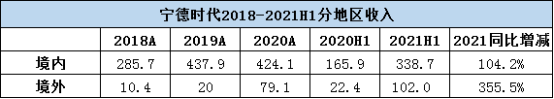

In terms of regions, CATL’s domestic revenue in the first half of the year reached 33.87 billion yuan, a year-on-year increase of 104.2%; overseas revenue was 10.2 billion yuan, a year-on-year increase of 355.5%. And the overseas revenue in the first half of the year has exceeded the overseas revenue for the whole year of last year.

From the perspective of overseas revenue over the years, the globalization of the CATL era has entered a performance realization period, and overseas new energy vehicle designated projects and energy storage cooperation projects have begun to accelerate. Taking into account the high gross profit margin of battery sales in overseas markets, CATL may increase the proportion of battery exports, and the proportion of overseas revenue may further increase.

Combining the disclosed data and a series of trends, the development of the Ningde era also reveals several key messages, and the stamina is full.

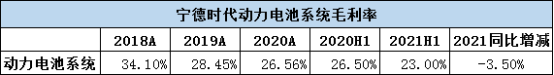

Cost control ability is prominent

In the first half of the year, CATL's power battery system gross profit margin continued to decline, reaching 23%. Correspondingly, the sales of new energy vehicles in the first half of the year increased more than expected, which put pressure on the supply of upstream materials for power batteries, including electrolyte (including lithium hexafluorophosphate, VC solvent), lithium carbonate, PVDF, copper foil and other materials. The price is getting stronger and stronger.

The continued decline in the gross profit margin of power battery systems also demonstrates that CATL has strong competitiveness in many aspects such as supply chain management, technological iteration, and process optimization.

The core idea is to increase production capacity, increase capacity utilization, and reduce unit manufacturing costs; to work closely with suppliers through technical cooperation, long-term agreements, joint ventures, etc., to ensure the technological advancement and reliability of raw materials and equipment. At the same time, improve cost competitiveness.

In terms of joint ventures and cooperation, Ningde Times successively established joint ventures with Fulin Precision and Defang Nano to build lithium iron phosphate material production capacity in the first half of this year.

In terms of long-term agreements, in May, CATL and Tinci Materials signed the "Material Supply Framework Agreement", stipulating the electrolyte supply guarantee for the use of 15,000 tons of lithium hexafluorophosphate, and the supply cycle is until June 30, 2022. According to estimates, the order will be able to guarantee the production demand of 100GWh power battery of CATL.

Excellent cost control capabilities will also further increase the competitive advantage with peers.

Power battery production capacity "fast forward"

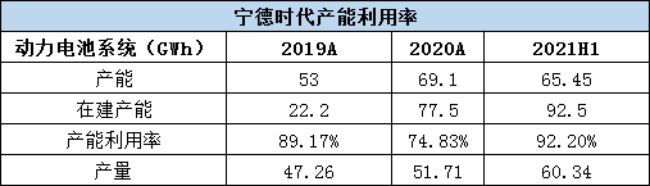

In the first half of the year, CATL’s power battery and energy storage system production capacity was 65.45Gwh, the under-construction production capacity was 92.5Gwh, and the capacity utilization rate was 92.2%.

In recent years, CATL has maintained a high level of capacity utilization while its production capacity has jumped. Driven by the goal of global carbon neutrality, the boom in new energy vehicles and energy storage at home and abroad continues to resonate, and the power battery production capacity of CATL has been significantly under pressure.

At present, the power battery and energy storage projects that CATL is accelerating under construction include: European production research and development base project, Times FAW power battery (and expansion) project, Times Guangzhou Automobile project, Cheliwan project, Fuding Times project, Sichuan Times (Yibin) ) Project Phases 2-6, Ruiqing Times (Zhaoqing) Phase I, etc.

It is worth mentioning that on August 12, CATL announced that it planned to increase 58.2 billion yuan to build 5 energy storage battery capacity projects in the four major bases of Fuding, Zhaoqing, Changzhou, and Ningde, totaling 137GWh, in addition to 30GWh storage. Energy and electricity cabinets, 7 billion yuan in new technology research and development, and 9.3 billion yuan in supplementary working capital projects.

The capital "grain and grass" blessing will enable its new production capacity to be further quickly implemented.

Energy storage circuit "Hurricane"

In the first half of the year, CATL’s energy storage system achieved revenue of 4.69 billion yuan, a year-on-year increase of 727.4%; and achieved a gross profit margin of 36.6%, a year-on-year increase of 12%.

As one of the three major directions of CATL’s corporate strategy, the energy storage business has become another growth engine besides power batteries and lithium battery materials.

According to Zeng Yuqun, chairman of the Ningde Times, “In the field of energy storage and power generation, especially the new type of solar cells, it can be combined, and then fixed fossil energy can be replaced.”

The forward-looking deployment of the Ningde era on the energy storage track has also begun to enter the cash-out period. At present, the company has successively won a number of large-scale energy storage projects by virtue of its scale and brand advantages. It has been bound to State Grid, State Power Investment, State Grid Comprehensive Energy, Yongfu, Nebulas, Costa, and Yi Shite and many other powerful energy storage partners.

According to foreign media in August, CATL has entered the Tesla energy storage supply chain and cooperated with it to build a lithium battery energy storage project with a total capacity of 6095kWh in Hokkaido.

Battery exports exceeded 10 billion

In the first half of the year, CATL achieved 10.2 billion yuan in overseas revenue, a year-on-year increase of 355.5%. Realized gross profit margin of 34.4%, a year-on-year increase of 5.2%.

If roughly estimated at the price of 1 yuan/wh system, the Ningde era's lithium battery exports in the first half of the year amounted to approximately 10.2GWh. Mainly from the booming development of overseas new energy vehicles and energy storage.

According to industry data, from January to June 2021, the registered volume of new energy passenger vehicles in 30 European countries was 1.023 million, a year-on-year increase of 157.1%, and the electrification rate increased from 11.5% in 2020 to 15.9%; the sales volume of new energy light vehicles in the United States was 190,000 The electrification rate will increase from 2.2% in 2020 to 3.1%. The increase in sales of new energy vehicles drives the growth in demand for power batteries.

According to forecasts, based on the implementation of the European Carbon Emissions New Deal and increased subsidies, the sales of new energy vehicles in Europe in 2021 are expected to exceed 2.6 million.

In addition, the overseas energy storage market represented by the United States, Germany, Australia, and Japan has been fully launched, continuing to drive the large-scale growth of energy storage battery demand.

The increase in the export ratio of power energy storage batteries and the increase in gross profit margin may further enhance the overall profitability of the CATL.

sodium ion tuyere on the station

It is worth mentioning that on July 29, CATL officially released the first-generation sodium-ion battery. The cell energy density of the first-generation sodium-ion battery cell has reached 160Wh/kg. Based on this product, it has also innovatively developed lithium Sodium hybrid battery pack.

Subsequently, on August 25, the Ministry of Industry and Information Technology responded to the proposal No. 4815 (Gongjiao, Post and Telecommunications No. 523) of the Fourth Meeting of the 13th National Committee of the Chinese People's Political Consultative Conference, stating that relevant departments will support sodium-ion batteries to accelerate the transformation of innovative achievements and support the mass production capacity of advanced products. Construction. Accelerate its application in new energy power stations, vehicles, communication base stations and other fields, promote the full commercialization, large-scale and low-cost sodium-ion batteries, and improve overall performance.

At present, CATL has started the industrialization layout of sodium-ion batteries, and plans to form a basic industrial chain in 2023.

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Bridgestone exits Russia and sells assets to S8 Capital

Free support line!

Email Support!

Working Days/Hours!