Scan QRCode

Everything seems to be coming back to square one. Without Ghosn, the Renault-Nissan-Mitsubishi alliance is in a fog.

Now the ship, lost in the middle of the ocean, is trying to find its way back.

At the end of May, The Renaut-Nissan-Mitsubishi alliance announced its next reform measures, which aim to use scale synergization to cut development costs through LEADER/FOLLOWER (" leader-follower model "), so as to improve the competitiveness and profitability of the three companies.

As early as February, the Renault-Nissan-Mitsubishi alliance was discussing its future direction. According to the plan, the alliance will divide the global market into regions to establish "benchmark companies" in relevant markets and tilt the resources of corresponding markets to benchmark companies.

According to the plan, Nissan, Renault and Mitsubishi are respectively the benchmark companies in the Chinese market, European market and Southeast Asian market.

In this program exchange, each benchmark market in the strategy of the play was further clarified. The primary aim of the new model is to streamline unprofitable businesses. In contrast to the concentration of power in the Ghosn era, the new model reduces the alliance's control over individual companies and creates synergy by giving play to the leading role of the big three in different markets. Reducing the cost of new car development and utilizing the overall scale synergy are becoming the main melody of the future development of alliance.

The battle for power may seem to be coming to an end, but behind the seemingly coziness, there is an undercurrent. If Mr Ghosn's departure has created a rift in the alliance's triangle, the black swan is widening it.

Even greater uncertainties about the future are brewing. Will Renault's much-publicised departure from China weaken the French's voice in the league? After a series of layoffs, plant closures, the strength of the alliance is still in the industry's first echelon? Can a new model of divide-and-rule, with separate powers, heal the rift between the coalitions?

After abandoning the merger, numerous problems still beset the shaky alliance.

grievances

1999 is an important time node.

At the time, Nissan was deep in debt, losing money for seven years and taking its total debt to $35 billion at one point. On the one hand, the pressure on the business is increasing; on the other hand, the original "messiah" is leaving. Against this backdrop, The White Knight "Renault" enters the scene to save the company from collapse.

On March 27th Renault agreed with Nissan to pay $5.4 billion for a 36.8% stake in Nissan and a 22.5% stake in Nissan diesel, with a guarantee to increase its stake to 44.4% in five years.

"Ghosn's Game" also began this year. Once in office, Mr Ghosn, who is known for his iron hand, made a radical change. Not only did it bring nissan back from the dead with Y2,100bn in debt and turn a profit in two years, it also brought forward its plans to revive itself.

Renault raised its stake in Nissan ahead of schedule to 44.4 per cent in March 2002, while Nissan took a 15 per cent stake in Renault in May. The cross-shareholdings put the two companies closer than ever, and the Nissan-Renault alliance was born. In 2005 Mr Ghosn became chief executive of the Nissan-Renault alliance.

Under Ghosn, the Renault-Nissan alliance was once the world's fourth-largest carmaker, behind General Motors, Toyota and Ford.

In 2016, more than 9.96 million vehicles were sold in nearly 200 countries. In terms of cost expenditure, the allied enterprises have saved about 16% compared with the previous year.

Mitsubishi Motors, another hapless carmaker, was suffering from falsified fuel consumption, foreign exchange losses and falling sales. In the 2016 fiscal year, Mitsubishi posted a net loss of $1.78 billion, while operating profit fell 94 percent to $45.8 million.

It was in the same year that Mitsubishi Motors met its bona fide patron, the Renault-Nissan alliance. Always charged with the goal of creating the world's largest carmaker, Mr Ghosn led Nissan to buy 34 per cent of Mitsubishi for Y237bn, making it the single largest shareholder. At that time, the outside world analysis, gambler Ghosn hoped to lead the group alliance to live in the auto giants of the big three, strive for the world's first ambition to germinate and take root.

When he took over as chairman, Mr Ghosn turned most of his attention to Mitsubishi. According to Ghosn's plan, in the future, Renault-Nissan and Mitsubishi Motors will not only cooperate in the production, procurement and manufacturing fields, but also unify the vehicle technology platform.

Mr Ghosn said: "The main reason mitsubishi's profits have not grown is that it has been selling around 1m vehicles a year." Gac Mitsubishi is part of mitsubishi's global Renaissance, with Ghosn starting to focus on The Chinese market.

For some time after that, Mitsubishi's business slowly picked up, and the Renault-Nissan alliance launched a formal attack on the world's top three car sales.

Finalizing it

In 2017, it was the moment of honor for the Nissan-Renault-Mitsubishi alliance.

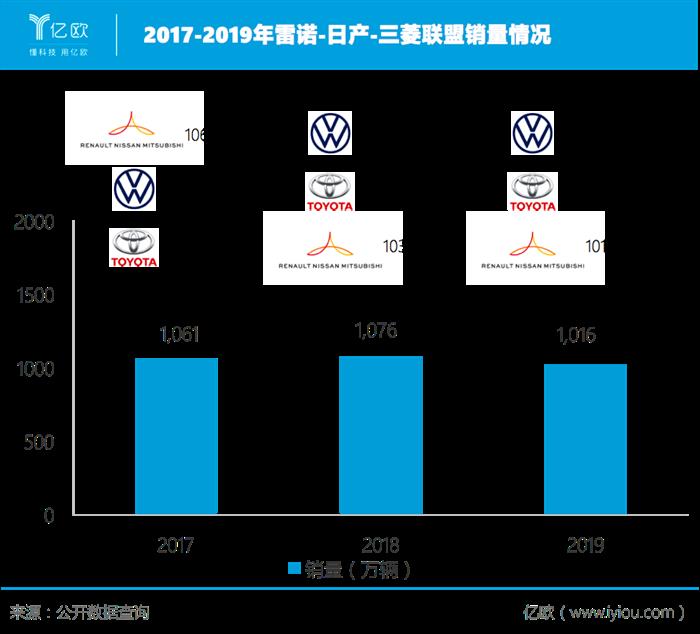

According to statistics, the total sales volume of the three manufacturers reached 10.61 million units in 2017, making them the largest light vehicle sales volume of the year. Volkswagen and Toyota came in second and third, respectively. A historical anecdote is thus born.

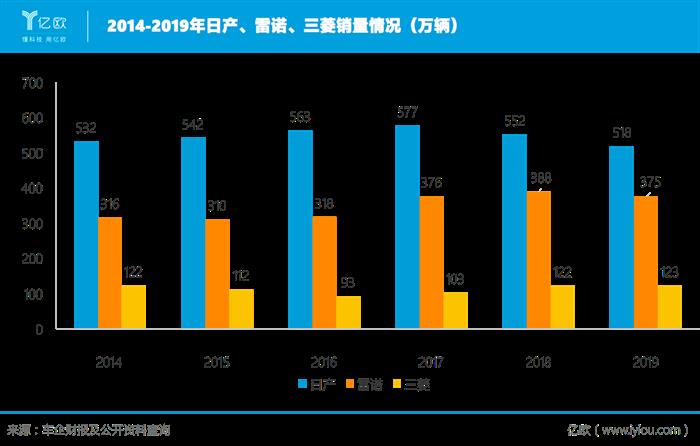

In terms of contribution, Nissan, Renault and Mitsubishi contributed 5.82 million, 3.76 million and 1.03 million vehicles respectively. At that time, Nissan was outstanding in the U.S. and China, with sales of more than 1.5 million units. Renault dominates the French and Russian markets. Mitsubishi motors' sales rose 10% from 2016. The Chinese market in particular has helped boost Mitsubishi's sales growth.

A blessing in disguises.

At the start of 2018, prompted by the French government, Ghosn began an aggressive push to merge Nissan, Renault and Mitsubishi in the hope of creating the world's largest car-making group and breaking the previous three-way race. Mr Ghosn has repeatedly said in public that the coalition must be restructured before he retires. But it was this that set off the tangled threads that led to Ghosn's arrest in November 2018.

The rush to jump out of danger and distance himself from Mr Ghosn continued.

In the meantime, news of the disintegration of the alliance was rife. The "office of the CHIEF executive", which ran the league's day-to-day operations and had several senior executives, was disbanded. Some renault-Nissan divisions are also downsizing, and news of job cuts is spreading unchecked.

On September 16, 2019, nissan board of Directors announced the formal resignation of CEO Hiroto Nishikawa (Ghosn's deputy), the era of Ghosn + Nishikawa came to an end. That has led to much speculation about the alliance's relationship.

Unsurprisingly, the alliance's downward trend has become a fait accompli. In total, the alliance between Nissan Motor, French giant Renault and Mitsubishi Motors sold 10.155 million vehicles in 2019, down 5.6 percent from a year earlier and dropping from second to third in the world, the data showed.

The more immediate effect seems to be more pronounced in the earnings reports of the three firms. The figures showed nissan's consolidated net income fell to Y9.88 trillion in 2019, with a net loss of Y671.2 billion. Renault posted its first annual loss in a decade in 2019, with revenue falling 3.3% from a year earlier to 55.54 billion euros and a loss of 141 million euros. Mitsubishi Motors' 2019 financial results showed that its operating profit plunged 88.6 percent last year to the lowest since the 2016 fiscal year. Sales fell 9.7 per cent year-on-year to Y2.27tn; A net loss of 25.78 billion yen.

The widening rift between the unions, caused by a dismal performance, also seems to confirm suspicions.

Life and death

During this period, the three enterprises in the whirlpool of public opinion did not miss any opportunity to save themselves.

The coalition has responded aggressively to Mr Ghosn's personal influence. In March 2019, Renault, Nissan and Mitsubishi reached an agreement to set up a new alliance operation committee with alliance operation as the core. Analysis of the industry believes that the joint establishment of the new alliance business committee indicates that the alliance is reconciling.

The alliance has since invested in tech companies such as The Mobility House and teamed up with Waymo to set up an innovation centre in Tel Aviv, Israel, in a series of responses that have The effect of declaring "we're fine".

The best response to talk of a "broken alliance" came in early 2020, when the de-gornised Renault-Nissan-Mitsubishi alliance unveiled a new framework agreement at the monthly meeting of the alliance's operating committee. The Renault-Nis-Mitsubishi alliance said it intends to further strengthen its business model and organizational structure. The new framework agreement will take advantage of their respective strengths to create more value for member companies and form strategic complementaries with them.

It's a matter of life and death, and a new business model to get back on track is finally in place.

Under this model, the situation of three parts of the global car market is formally produced. Among them, Nissan assumed the benchmark company in China, North America and Japan. Renault takes on the role of the benchmark company in Europe, Russia, South America and North Africa; Mitsubishi has taken on the role of a benchmark in Southeast Asia and Oceania.

Jean-dominique Seinard, chairman of the Alliance operations Committee and Renault, said the alliance has created a unique strategic operating partnership in the automotive industry, and the new business model will enable the alliance to leverage each company's asset strengths and execution capabilities.

In addition to establishing benchmarking companies in the market, the alliance also released new cooperation programs in technology and related regions, not only from the platform to the body, to further confirm the standards. It also requires that for each product segment, emphasis is placed on the basic and derived models designed by the leader, with support provided by the accompanist.

The alliance also noted the need to ensure that the leading and accompanying models of each brand are produced in the most competitive configurations, including platform sharing where appropriate. That means future Renault plants in Europe could see Nissan models in production. In addition, the alliance will continue to deepen the exploration of light commercial vehicles. Under the "leader-accompanist" model, investment in models made by members could save up to 40 percent of costs, the alliance said.

To the outside world, this middle ground is a compromise between coalition members. Under the surface, everything is getting better.

Collapse or reshape?

Among all the competing markets, the role of The Chinese market is obvious.

In 2019, Nissan sold 5.1762 million vehicles globally out of the 10.1552 million units sold by the Renault-Nissan Mitsubishi Alliance. That compares with about 1.54 million for Nissan in China. So it should come as no surprise that Nissan is the alliance's leader in China.

According to nissan's development plan, it aims to achieve sustainable growth, stabilize its financial position and improve profitability by the end of fiscal year 2023. In the future, Nissan will focus on Japan, China and North America.

In terms of product layout, Nissan plans to launch 12 models over the next 18 months. Among them, electrification was defined as the key direction, and the sales proportion of models was increased to 60%.

In The first three months of this year, despite the impact of the epidemic, Dongfeng Nissan's share of joint ventures in non-luxury brands was still on the rise, making it one of the few companies to outperform the market.

But in one dimension, Nissan's leadership advantage in China is eroding. In 2017, Nissan was also the number one selling Japanese cars in China. But in 2019, it was already behind Honda and Toyota in China, a trend that will not slow in 2020.

Look at the other two enterprises in the alliance, in product update iteration also reflects in addition to the lack of momentum.

The turmoil within Renault is also important for the company's operations. Since the Ghosn incident, Renault high-level unrest continues to occur. Thierry Bollore, Renault's chief executive, was "ousted" shortly after Mr Ghosn's arrest. Jean-dominique Senard, Renault's chairman, has said publicly that he wants Mr Bollore to step aside as chief executive.

In the first quarter of this year, Renault's revenue fell 19 percent from a year earlier to 10.1 billion euros due to the outbreak. Sales in Europe fell by as much as 36 per cent, as the impact of the embargo during the COVID-19 outbreak became apparent.

Bruno Le Maire, the French finance minister, had said Renault could soon go bankrupt if it did not get quick financial help to deal with the COVID-19 outbreak.

There were early signs of Mitsubishi's malaise.

In the third quarter of fiscal 2019 (October-December 2019), Mitsubishi Motors suffered its biggest quarterly loss, with an operating loss of 6.6 billion yen. Mitsubishi Motors said it would cut base salaries for senior executives, executives and company executives by 20 to 30 per cent for the fiscal year starting April 1, and eliminate 12 months of merit pay.

While trying to break the impact of the epidemic, and at the same time, in-depth exploration of the current advantage market, will become the next focus of the alliance members layout. But it is hard to guarantee an efficient balance between pulling and pulling.

Nissan's grievance with Renault is well known. Nissan contributes the most sales and profits, but in the end it is Renault that makes the most because of its stake. And Nissan has long complained about Renault's efficiency. According to Reuters, a Nissan insider once said: "Nissan engineers can produce 40 per cent more during the same working hours than Renault."

But on the other hand, the ability to maintain the alliance also indicates that the relationship between the three car companies has been eased.

"After the rain, the ground will be stronger." One Nissan insider cites a Japanese proverb to illustrate how alliances can get closer after a conflict.

Is this really the case? Will the future of the alliance collapse or be reshaped? It's still unknown.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!