Scan QRCode

China's car market has received a rare piece of good news when it was hit by the "black swan" epidemic.

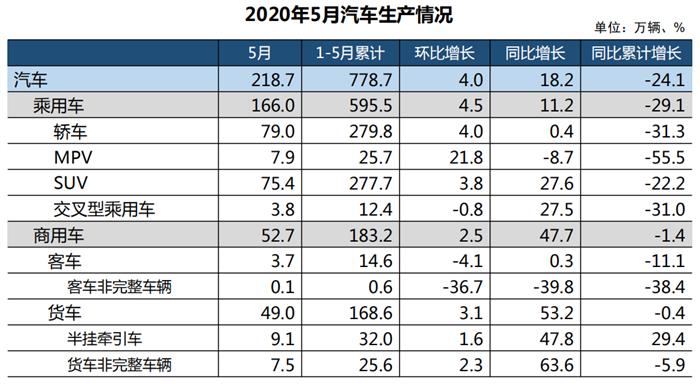

On June 11, the China Association of Automobile Manufacturers released data on China's auto industry production and sales last month. In May 2020, China's automobile production and sales reached 2.187 million units and 2.194 million units respectively, with year-on-year growth of 18.2% and 14.5% respectively. The production and sales of automobiles in China continued to improve. It was also the first double-digit growth since Auto production and sales in China rebounded in April. In addition, the growth rate of passenger car production and sales turned positive for the first time in nearly 11 months.

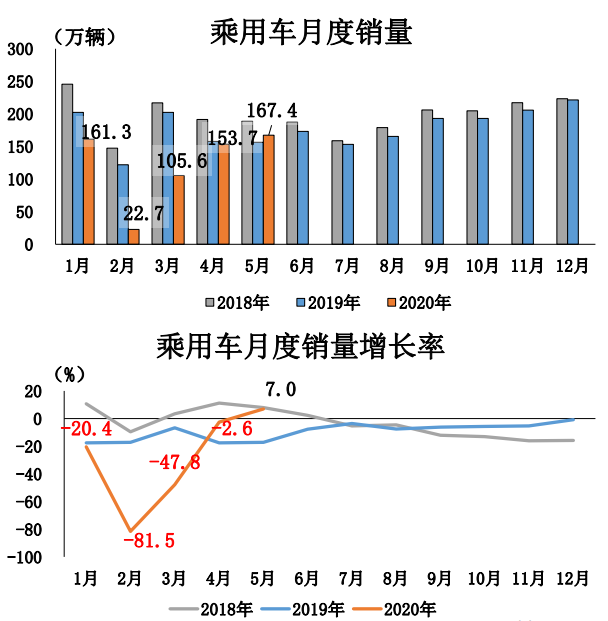

In May, 1.66 million and 1.674 million passenger vehicles were produced and sold, up 11.2% and 7.0% year-on-year. The production and sales of commercial vehicles totaled 527,000 and 520,000 units, with the output increasing by 2.5% month-on-month and the sales decreasing by 2.6%, with the year-on-year growth of 47.7% and 48%.

From January to May, automobile production and sales totaled 7.787 million and 7.957 million, down 24.1 percent and 22.6 percent year on year, respectively narrowing the decline by 9.3 percentage points and 8.5 percentage points compared with the first four months.

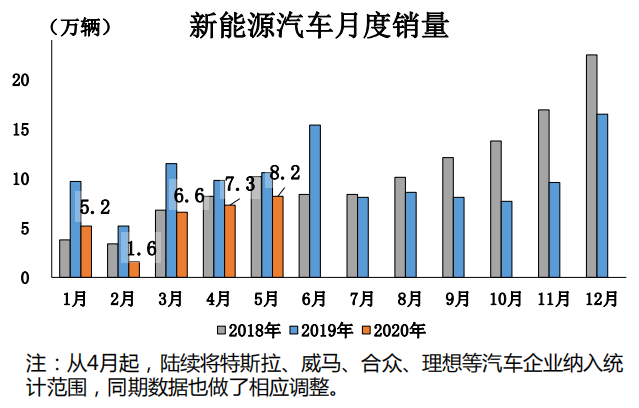

Meanwhile, sales of new energy vehicles are still in decline. In May, new energy vehicles totaled 84,000 and 82,000, respectively, down 25.8 percent and 23.5 percent year on year. From January to May, 295,000 and 289,000 new energy vehicles were produced and sold, down 39.7 percent and 38.7 percent, respectively, year-on-year.

From the overall situation of automobile industry production and sales in May, its performance features are as follows: automobile production and sales maintain growth, passenger vehicle production and sales growth turns from negative to positive, commercial vehicle production and sales increase significantly year-on-year in a single month, new energy vehicles continue to decline year-on-year, Chinese brand passenger vehicle market share declines, and automobile export declines year-on-year.

In this regard, the China Association of Automobile Manufacturers said that in May this year, the situation in China's fight against the epidemic continued to improve, enterprises accelerated the resumption of work and production, and solid progress was made in stabilizing employment. At the same time, driven by a series of favorable policies of the central and local governments, consumer confidence has been improved, and the restrained demand of some consumers has been speeded up and the auto market has gradually recovered.

In addition, according to the relevant person in charge of the China Automobile Association, "the new energy vehicle market will not see explosive growth this year. "Manufacturers are in the process of understanding and adapting policies and adjusting products to meet consumer needs through scale and other means."

(Automobile production in May 2020)

(Automobile sales in May 2020)

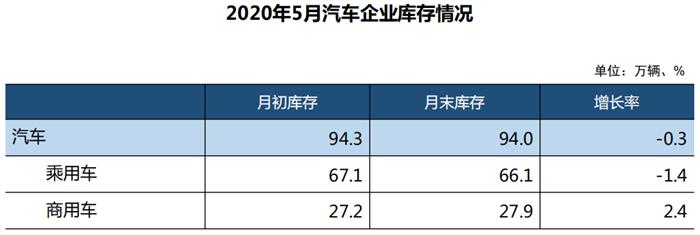

(Inventory of automobile enterprises in May 2020)

Passenger car market: the end of year-on-year decline in sales

In May, passenger car sales continued to show improvement, with month-on-month growth and year-on-year decline ending. A total of 1.674 million units were sold in the month, up 8.9% month-on-month and 7.0% year-on-year.

From January to May, sales of passenger vehicles totaled 6.109 million units, down 27.4 percent year on year and 7.9 percentage points less than in The first four months of the year. Among the main types of passenger vehicles, the sales decline of the four categories of passenger vehicles continued to narrow compared to the january-April period.

Judging from the development trend of the industry, although the situation of epidemic prevention and control in China is getting better at present, there is still a long way to go for the recovery of domestic macro-economy. With the uncertainty of the international epidemic, overseas market demand has not yet recovered, and export-dependent enterprises have not yet gotten out of the woods, which will cause the recovery of domestic consumer demand to lag behind.

(Passenger car sales in May 2020)

New energy vehicle market: the decline is still not contained

In May, 84,000 and 82,000 new energy vehicles were produced and sold, down 25.8% and 23.5 percent year-on-year, respectively. Among them, 63,000 and 64,000 pure electric vehicles were produced and sold, down 33.8% and 25.1% year on year, respectively. Plug-in hybrid electric vehicle production

Sales reached 21,000 and 18,000 respectively, among which production increased by 17.1% year-on-year and sales decreased by 16.1% year-on-year. The production and sales of fuel cell vehicles were 17 and 42, respectively, down 94.6% and 86.7% year-on-year.

From January to May, the production and sales of new energy vehicles totaled 295,000 and 289,000, respectively, down 39.7 percent and 38.7 percent year-on-year. Among them, 222,000 pure electric vehicles were produced and sold, down 42.8% and 39.8% year-on-year respectively. The production and sales of plug-in hybrid electric vehicles reached 72,000 and 67,000, respectively, down 27.5% and 35.0% year-on-year. The production and sales of fuel cell vehicles were 309 and 322, respectively, down 44.1% and 40.9% year on year.

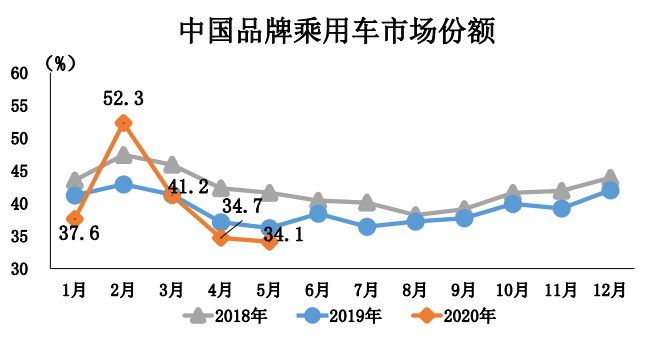

Vehicle data: Market share of self-owned brands declined

In May, the sales volume of Chinese brand passenger cars increased slightly from the previous month, ending a year-on-year decline with a slight increase. A total of 571,000 vehicles were sold, up 7.1% month-on-month and 0.4% year-on-year, accounting for 34.1% of the total sales volume of passenger vehicles. The share decreased 0.6 percentage points compared with last month and 2.2 percentage points compared with the same period of last year.

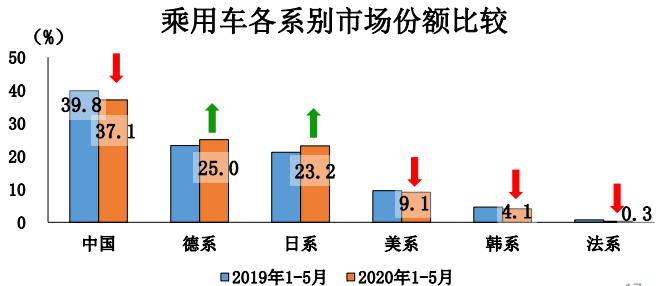

From January to May, A total of 2.264 million Passenger vehicles were sold by Chinese brands, down 32.5% year on year, accounting for 37.1% of the total sales volume of passenger vehicles and 2.8 percentage points lower than the same period of last year.

Compared with the same period last year, from January to May of 2020, German brands and Japanese brands showed obvious growth, with their market share increasing by 25.0% and 23.2% year-on-year. American, Korean and French brands experienced market share declines of 9.1 percent, 4.1 percent and 0.3 percent, respectively.

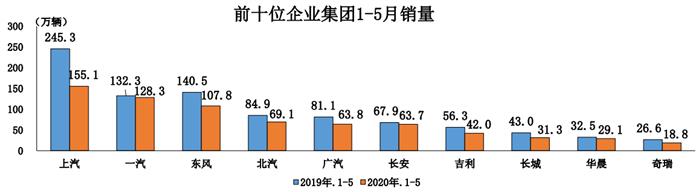

From January to May, the market concentration ratio of key enterprise groups was higher than that of the same period. The sales volume of the top 10 enterprise groups totaled 7.089 million units, down 22.1% year-on-year, 0.5 percentage points less than the industry decline. It accounted for 89.1% of total auto sales, up from 0.6 percentage points a year earlier.

New energy market: Charging pile market growth slowed down

In May, China's power battery output was 5.2GWH, 47.7% lower than that of last year, and 9.9% higher than that of last month. Among them, the output of SANYUAN battery is 3.1GWh, accounting for 59.1% of the total output, 52.4% lower than that of the previous year and 7.2% higher than that of the previous month. The output of lithium iron phosphate battery was 2.1GWh, accounting for 40.5% of the total output, down 9.6% year on year and up 13.8% month on month.

From January to May, China's power battery output has been 18.2GWh, down 50.9% year on year. Among them, the total output of SANYUAN battery is 11.6GWh, accounting for 64.0% of the total output and 49.1% lower than that of the previous year. The total output of lithium iron phosphate batteries was 6.5GWh, accounting for 35.7% of the total output, down 46.8% year-on-year.

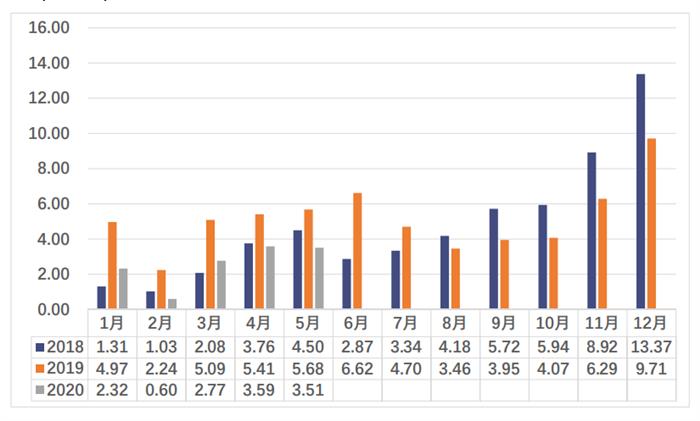

In May, China's power battery loading volume was 3.5GWh, down 38.3% year on year and 2.3% month on month. The total loading volume of Sanyuan battery is 2.7GWh, down 27.7% year on year and up 2.0% month on month. The total load volume of lithium iron phosphate battery was 0.8GWh, down 54.7% year on year and 13.1% month on month.

From January to May, China's power battery load accumulates 12.8GWh, down 45.4% year on year. Among them, the accumulative load volume of ternary battery is 9.6GW, accounting for 75.3% of the total load, down 42.2% year-on-year. The total loading volume of lithium iron phosphate battery is 3.1GWh, accounting for 24.1% of the total loading volume, which is down 49.7% year-on-year.

(Data of China's power battery monthly load in May 2018-2020)

In May, a total of 42 power battery companies in China's new-energy vehicle market realized supporting vehicle loading, one more than in April. The power battery loads of the top 3, top 5 and top 10 power battery companies are 2.4GWh, 2.9GWh and 3.3GWh respectively, accounting for 67.1%, 81.5% and 92.8% of the total load, respectively.

(China's power battery enterprises loading volume ranking in May 2020)

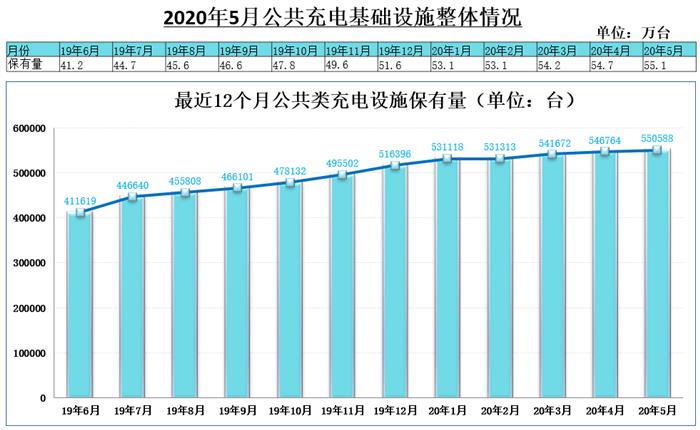

By May 2020, members of the Alliance have reported a total of 551,000 public charging piles, including 321,000 AC charging piles, 229,000 DC charging piles and 488 AC-DC integrated charging piles. From June 2019 to May 2020, an average of 12,000 new public charging piles will be added each month.

In May 2020, there were 3.8 thousand more public charging piles than that in April, with a year-on-year increase of 37.4% in May. At present, the industry is still affected by the COVID-19 epidemic, and the number of new charging piles is still low.

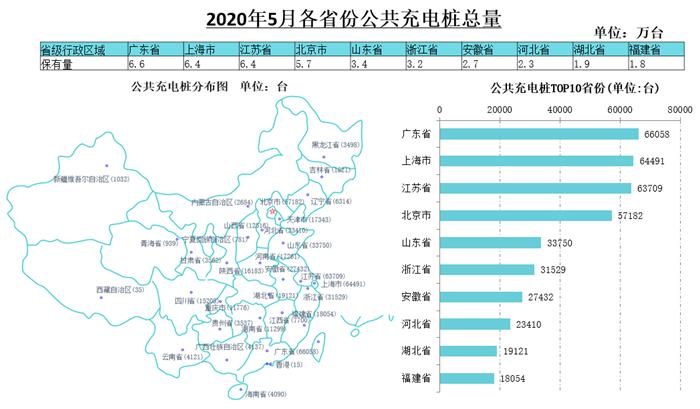

Guangdong, Shanghai, Jiangsu, Beijing, Shandong, Zhejiang, Anhui, Hebei, Hubei and Fujian have built 73.5% of the public charging infrastructure.

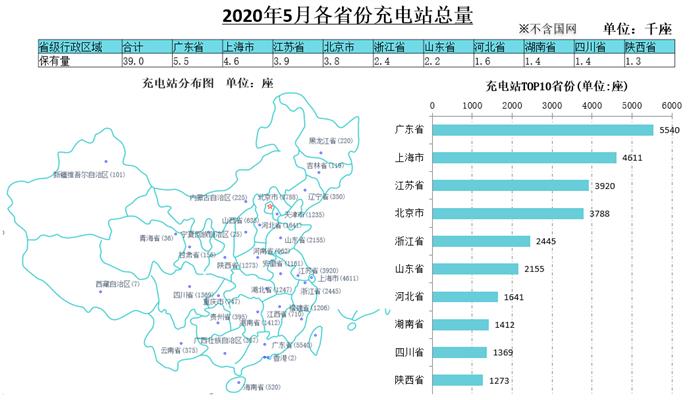

As of May 2020, the national charging charging pile number more than 10000 operating companies will operate a total of eight, respectively is: call operating 157000 units, 132000 sets of stars charging operation, state grid operation 88000 units, 41000 sets of cloud fast filling operation, in accordance with the 25000 sets of energy operation, saic bio operating 19000, China putian operating 14000 units, 13000 sets of car in shenzhen power grid operation. The eight operators accounted for 88.8 percent of the total, with the remaining 11.2 percent.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!