BYD has launched a globalization strategy since 2022 and has achieved remarkable results in overseas markets. Its overseas sales from January to August exceeded 630000 vehicles, far exceeding the full year of 2024. Especially in the European market, ACEA's latest data shows that in September, BYD not only surpassed Tesla in sales in multiple countries, but also topped the new energy sales chart in countries such as Italy and Spain. However, compared to Europe where Chinese car companies are clustered, the Japanese car market is like a tough nut to crack, making it difficult for foreign brands to enter. BYD is the first Chinese car company in the 70 year history of the Chinese automotive industry to enter the Japanese market, and so far, it is also the only Chinese brand to have a deep layout in this market. Japan is the fourth largest automobile market in the world, second only to China, the United States, and India. This vast market has always been dominated by powerful local brands, with a market share of over 94%. Even though Japan abolished tariffs on imported cars in 1978, foreign brands have always struggled to truly enter the market due to strict certification procedures, complex market preferences, and high consumer loyalty to local brands. In this context, BYD's entry demonstrates tremendous strategic courage.

Create a new model of "localized special supply" for going global

BYD K-EV challenges the Japanese K-Car market landscape

On October 29th, BYD unveiled its K-EV BYD RACCO specifically designed for the Japanese market at the 2025 Japan Mobility Expo (referred to as the "Tokyo Motor Show").

This is BYD's second participation in the Tokyo Motor Show. Since July 2022, BYD has officially announced its entry into the Japanese passenger car market. Over the past three years, BYD has personally experienced the complexity and difficulties of the Japanese passenger car market. After a difficult initial stage, BYD has launched four models in Japan, including the Yuan PLUS, Dolphin, Sea Lion, and Sea Lion. It has also established 66 sales bases nationwide and hired Japanese national actress Masami Nagasawa as its brand spokesperson. BYD has put a lot of effort into market promotion and channel development.

However, as of the first half of 2025, BYD's cumulative sales of passenger cars in Japan are approximately 6600 units. This is insignificant compared to BYD's global sales and far below its initial expectations. The head of BYD's Japan business said, 'Our sales were one zero less than initially expected.' The poor sales performance is closely related to the low acceptance of electric vehicles by Japanese consumers. As of September 2025, the penetration rate of new energy in Japan is only 2.8%, and the penetration rate of pure electricity market is 1.7%, far lower than that of China and the European and American markets. Even Toyota will only sell 2038 domestic electric vehicles in 2024. In contrast, BYD has performed outstandingly in the field of imported electric vehicles, with sales of electric vehicles in Japan reaching 2223 units during the same period, a year-on-year increase of 54%. As of September this year, BYD's sales have accounted for 20% of Japan's total electric vehicle imports. To break through the market, BYD attempted to penetrate the core areas of the Japanese automotive market by developing models that comply with Japan's special regulations and consumer preferences, giving rise to RACCO. RACCO "is derived from the Japanese word" ライこ "(sea otter), and this pure electric K-EV has attracted a lot of attention from Japanese media during the testing phase, bringing considerable pressure to local car manufacturers. According to Nikkei Chinese, Suzuki President Toshihiro Suzuki said, "There are many standards for small cars in the world, and BYD has chosen Japan's light vehicle standard. I am very happy. New competition is about to begin." He also believes that BYD is a huge threat. K-Car is a unique model in the Japanese automotive market, referring to light vehicles with a displacement of 660cc or less, a length not exceeding 3.4 meters, a width not exceeding 1.48 meters, and a height controlled within 2 meters. This model accounts for about one-third of new car sales in Japan and is highly favored by Japanese consumers due to its affordable price, low maintenance costs, and tax incentives. In 2024, K-Car accounted for 35.2% of new car sales in Japan, with an annual sales volume of 1.557 million units.

日本首款量产轻型车铃木Suzulight

BYD's entry into the Japanese market with K-Car demonstrates a deep understanding of the Japanese market. The brand strictly follows the Japanese K-Car standard and adopts designs such as sliding doors on RACOO that are suitable for narrow streets in Japan. In addition, RACOO is equipped with a 20kWh battery pack, with a WLTC range of 180km and support for 100kW fast charging, fully meeting the daily commuting needs of Japanese households of 37km. BYD believes that K-EV is not only a means of transportation, but also represents the local automotive culture - the ultimate utilization of space and the smart travel that adapts to narrow streets and alleys. Given the slow electrification transformation of Japanese domestic car companies, BYD has the opportunity to leverage its globally leading battery and three electric technology and price advantages to bring disruptive product experiences to Japanese consumers. The current K-Car market has long been dominated by local brands such as Suzuki and Daihatsu, and with the entry of RACOO, this situation may be impacted.

According to reports, the selling price of RACCO may be around 2.5 million yen (approximately 117000 to 133000 yuan), lower than the starting price of Nissan Sakura at 2.7 million yen. Combined with the Japanese government's 300000 yen electric vehicle subsidy, the actual purchase price for consumers can be reduced to 2.2 million yen, which will directly shake the choice of price sensitive consumers. BYD stated that RACCO will be officially launched in the summer and autumn of 2026, and it will offer two endurance versions to meet the needs of different living scenarios.

Using China's plug-in hybrid technology to counterattack the Japanese hybrid market

Japan has a cold climate and high electricity costs, with relatively lagging infrastructure such as charging stations and networks. In addition, BYD also faces cultural cognitive barriers. BYD Japan President Liu Xueliang also admitted that "some Japanese people don't like Chinese products". To make consumers understand, recognize, and ultimately use BYD to electric vehicles, it requires not only courage, but also enormous patience and sustained investment costs. In the face of the low popularity of education and charging facilities in the pure electric market, BYD must accept the reality and find new ways to rapidly expand its market share.

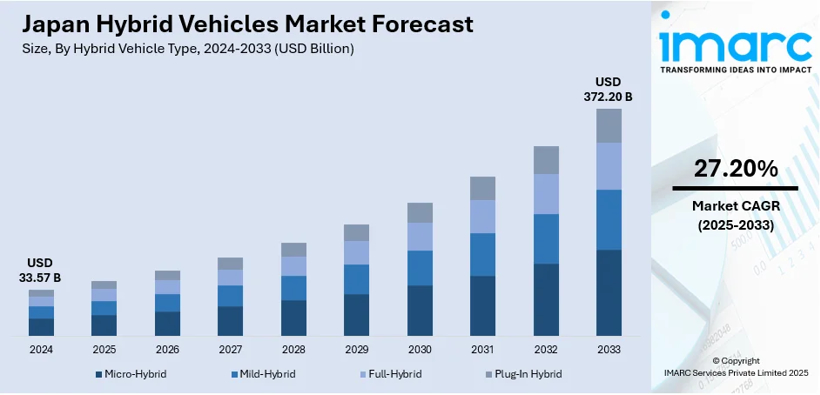

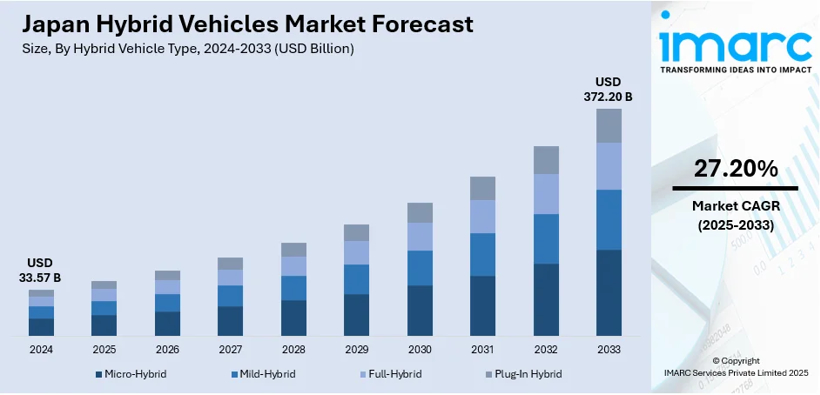

If the launch of RACCO is BYD's attempt to seize the opportunity of electrification transformation and break through the barriers of the Japanese market through localized products and cost advantages, it is a rare high-risk move. So, introducing plug-in hybrid models to the Japanese market is a low-risk, high return move for BYD to integrate its plug-in hybrid technology into the Japanese automotive market. Data shows that in 2024, the sales of hybrid cars in Japan exceeded 2.04 million units, breaking through the 2 million mark for the first time. In some years, hybrid models even account for over 60% of new car sales. Driven by rising oil prices and consumers' pursuit of energy efficiency, the Japanese hybrid vehicle market continues to grow in size. Market research firm IMARC Group predicts that by 2033, the size of the Japanese hybrid car market will reach 372.2 billion US dollars.

At the Tokyo Motor Show, BYD officially introduced its first plug-in hybrid model, the Sea Lion 06DM-i, with a "pure electric+hybrid" dual line strategy, and plans to form a layout of 7 to 8 pure electric and hybrid models in Japan before 2027. Considering that the Japanese market has long been dominated by hybrid vehicles and this trend will continue in the future, BYD's move demonstrates its flexible and flexible market expansion strategy. The introduction of new powertrain models will accelerate BYD's penetration into the Japanese market.

Japan is a global leader in hybrid electric vehicles (HEVs), and local brands such as Toyota have a strong market foundation and consumer trust in this field. By launching plug-in hybrid models, BYD can not only effectively avoid the problems of weak charging infrastructure and high electricity prices in Japan, but also better connect with the existing consumption habits of Japanese consumers. This also means that BYD will face competition from local brands such as Toyota and Honda in the plug-in hybrid market. As a pioneer in hybrid technology, Toyota continues to upgrade its core hybrid technology, with multiple core models such as the Prius, RAV4, and Camry maintaining leading sales advantages globally. Honda, Nissan, and other Japanese brands also have mature hybrid technology, jointly building strong local brand barriers and firmly controlling the Japanese hybrid market. BYD's entry into the hybrid market in Japan tests its DM-i technology and cost control capabilities. BYD will challenge the dominant position of Japanese brands in the traditional hybrid field with China's plug-in hybrid technology. The high efficiency and low fuel consumption advantages of DM-i technology may bring better performance and more cost-effective plug-in hybrid products to Japanese consumers. BYD is steadily establishing brand awareness and making initial breakthroughs. The launch of BYD RACCO and Sea Lion 06DM-i models will provide greater possibilities for BYD to penetrate the Japanese market. BYD's attack has just begun.

English

English Chinese

Chinese