Scan QRCode

How should China's new energy face overseas capital when the Big three in Japan and the big three in Germany are embracing each other?

Another carmaker has fallen in love with a Chinese battery firm, following Vw's marriage of Guoxangaoke and Benz to Fenergy. This time, the story is about Honda and the Ningde era.

Honda takes a stake in Ningde Times

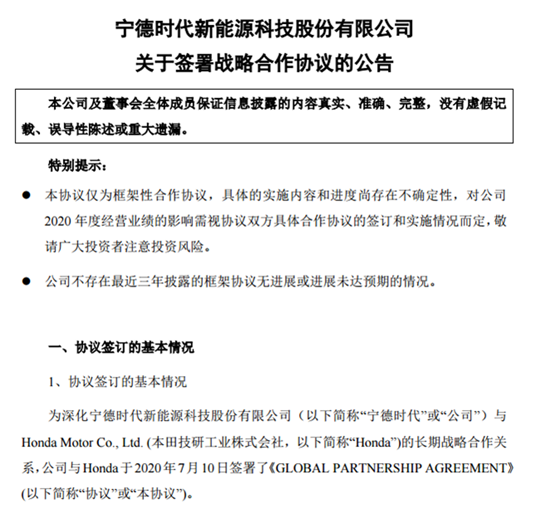

On July 10, Ningde Times announced that it signed a comprehensive strategic cooperation agreement with Honda (HDAA) on new-energy vehicle power batteries to strengthen the promotion of electric vehicles and accelerate the strategic partnership.

At the level of business cooperation, on the one hand, Honda and Ningde Times will combine their technological advantages to jointly develop new energy vehicle power batteries and future battery basic technologies. On the other hand, through the cooperation, Honda will get a steady supply of ningde Times battery, which is mainly based on pure electric vehicle (BEV) batteries. The first china-made new energy vehicle models equipped with Ningde Era power batteries are expected to be launched in the Chinese market in 2022. The two sides will also discuss expanding cooperation in the global field in the future.

In addition, the two sides will also carry out cooperation discussions on the future recovery and reuse of power batteries.

In terms of capital cooperation, Honda will participate in the subscription of the non-public shares of Ningde Times, and the number of shares subscribed will account for about 1% of the total share capital of the company after the non-public shares issued. Through the investment subscription equity, Honda will become an important strategic partner of Ningde Times.

In fact, before the strategic cooperation is reached, Ningde Times has cooperated with many domestic and foreign automobile enterprises, including Tesla, BMW, Mercedes, Toyota, Volkswagen, Nextev, Xiaopeng, Chang 'an, GAC, SAIC, Beijing Auto, Geely, Dongfeng, etc. Among them, Although Changan, Dongfeng and SAIC have also bought stakes in Ningde Times before, Honda is the first foreign car company to do so.

It's worth noting that this isn't the first time the Ningde era and Honda have held hands. As early as May 2018, Nippon Keizai Shimbun reported that Honda and Ningde Times would jointly develop new batteries for the main models of pure electric cars and jointly develop an electric car, which is expected to be launched in China and other regions in the first half of 2020. Japanese media pointed out at the time that Honda's adoption of important components made by Chinese suppliers was a trend in the globalization of electric vehicles.

The news was not confirmed until February 2019, when the two signed a cooperation agreement in Tokyo, Japan. Under the agreement, Ningde Times will supply Honda With about 56GWh of lithium-ion batteries by 2027. In addition to the Chinese market, the models of this cooperation will also be launched in other markets around the world.

This means that the signing of the cooperation agreement is another upgrade of the past partnership between the two sides. Spokesmen of both sides agreed that through this strategic cooperation, they will establish a closer global partnership.

How should China's new energy face?

Japanese auto companies joined hands with Chinese battery manufacturers, on the one hand, based on the consideration of localized battery production. On the other hand, mainly out of recognition of the latter's technical level and market performance. According to public data, Ningde Times, BYD and Guocaoko rank top three in China's power battery installation list in 2019, with 31.71GWh, 10.76GWh and 3.31GWh respectively. Among them, the installation volume of Ningde Times power battery accounted for half of the country, accounting for 9.86 percentage points of the comparison in 2018.

Japanese cars are in a relatively weak position when it comes to pure electricity, and the "weak cluster" doesn't solve the fundamental problem, so they still have to work with Chinese battery manufacturers or battery pack suppliers. Whether it is Honda, Toyota or Nissan, the Big three are clearly aware of this.

Last July, BYD and Toyota announced that they had signed a contract to jointly develop pure electric models for cars and low-chassis SUVs, as well as the power batteries needed for such products. The partnership will use the Toyota brand and be launched in China by 2025.

Last month Toyota was eclipsed by Tesla, which is now jealous of the all-electric market. However, as early as last June, Toyota had already brought forward its target of selling 5.5m all-electric vehicles by 2030 to 2025, opting for a more all-electric model. So Toyota's choice of BYD is understandable.

Nissan also announced last month that it was working with Synwanda to develop next-generation batteries. In June, Nissan announced that it would jointly develop the next generation of on-board batteries for nissan's E-Power smart battery technology.

Nissan built its battery business in China back in 2017 when it sold the AESC business to GSR Ventures. Some readers may wonder why selling batteries can be read as "layout".

On the one hand, nissan plans to buy batteries from outside, rather than just AESC batteries, for the sake of battery economy. In other words, global sourcing will give Nissan more sources of battery supply and more flexibility in configuration.

On the other hand, from the perspective of the Chinese market, the industry has recognized that the AESC handover to China is conducive to gaining government recognition in China. At the time, AESC batteries were on board chang Long buses, which had entered the fifth batch of companies in the recommended list. Therefore, if the Pure electric car Leaf of Nissan continues to carry ASEC battery, it will be conducive to entering the Recommended Models Catalog of New Energy Vehicles Promotion and Application, so as to obtain subsidies.

Therefore, it can be seen that By selling AESC to Chinese companies, Nissan hopes to improve the competitiveness of new-generation electric cars in the global market, especially in China, from many aspects.

Of course, it is not just Japanese carmakers. As mentioned at the beginning of this article, German giants such as Volkswagen and Daimler have taken a similar path.

At the end of May, Volkswagen announced that it would invest 1.1 billion euros to acquire 26.47% stake in Guoxenggaoke, making it the largest shareholder of guoxenggaoke and the first foreign auto company to invest directly in a Chinese power battery manufacturer.

Earlier this month Daimler, another German luxury-car maker, announced it was joining the electric arms race. It announced a far-reaching strategic partnership and a stake in The Chinese company, with a stake of about 3 per cent.

Honda's stake in Ningde times is the third in just over a month for a foreign carmaker to buy into a Chinese battery company. For a long time to come, there will be a lot of rumors about foreign car companies deeply binding local battery companies.

This means that overseas car companies are piling into China's new energy vehicle market and even taking control of battery suppliers. So, how should China's new energy face overseas capital? On the one hand, a more open market is indeed conducive to improving industrial activity, but on the other hand, it may also lead to the impact on the current relatively limited advantages of new energy. In terms of cell manufacturing, China has an obvious scale advantage compared with Europe and the United States.

For the whole grand idea of China's new energy vehicles, the involvement of overseas enterprises will bring technological and manufacturing benefits on the one hand, and on the other hand may divide up the supply chain system and vehicle share, which still presents both opportunities and challenges.

The same approach applies to ambitious people, who make choices and meet challenges, and improve themselves by making investments in advanced technology; For the unmotivated, perhaps, looking to an "outside friend" to get the job done is clearly not good for the new energy cause.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!