Scan QRCode

After 12 months of continuous sales, "go to the countryside", as a new hope for new energy vehicles bottoming out.

The Ministry of Industry and Information Technology (MIIT) and the Ministry of Commerce have jointly issued a notice on the campaign to send new energy vehicles to the countryside, announcing that from July to December this year, 10 auto companies will offer 16 preferential models, and local governments will also issue supportive policies. Take Changan Benben E-Star as an example, the total amount of financial, replacement, charging pile and other preferential measures exceeds 10,000 yuan.

The last time the authorities rolled out a policy was in 2009, when the car market grew 46.1 per cent year on year. The new energy vehicles into the countryside, for the market brought unlimited imagination.

With 600 million rural population and 4.04 million km of rural roads, the sinking market has become a potential blue sea in the context of the declining car market.

"By 2030, the 1,000 rural vehicle PARC is expected to reach 160, with the total PARC exceeding 70 million, and the new products are likely to shift to electric vehicles." Small, economical electric vehicles will be a major new product in the future, or a market of tens of millions of vehicles in third - and fourth-tier cities and rural areas, Chen Qingtai, President of the China Electric Vehicle Association of 100, said at the Auto Market and Consumption Forum on July 18.

However, new energy vehicles are still in the early stage of development, the infrastructure is not perfect, the road to popularization is still difficult.

Ling Ran, an auto industry analyst, told ID: Auto-Time that there is still a big gap between the product quality of new-energy vehicles and that of traditional fuel vehicles, and there are still many obstacles to their promotion in rural areas. The new energy car that falls for a year in a row, how should hit this "hard bone"?

"50,000 yuan is the ceiling"

Third - and fourth-tier cities and rural markets have become recognized new growth points in the new energy vehicle market.

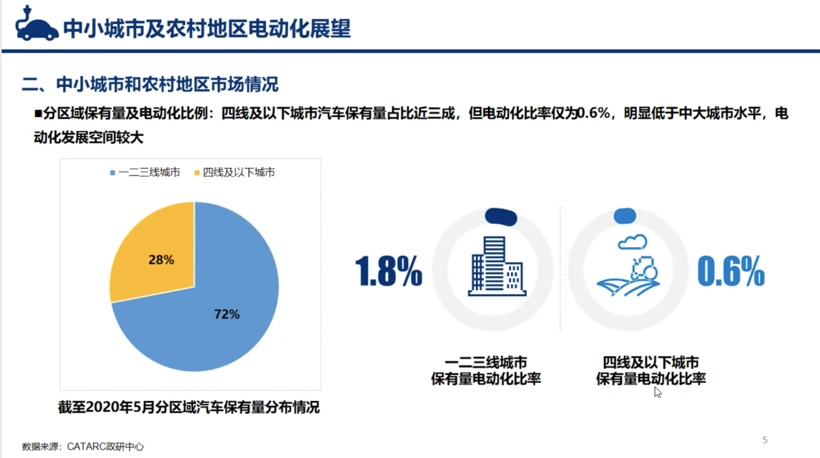

According to the CATARC Center for Political Science and Research, by May 2020, the number of cars in fourth-tier cities or below accounted for nearly 30 percent of the country's car population, but the electrification rate was only a third of that in first-tier, first-tier cities, at 0.6 percent. In terms of sales volume, from January 2019 to May 2020, the sales volume of urban vehicles below the fourth tier accounts for 24% of the total sales volume in China, while electric vehicles account for less than 1%.

Source: Automotive Market and Consumer Forum

But at the same time, sales of four-wheel low-speed electric vehicles in small and medium-sized cities and rural areas have increased year by year in recent years. Sales of four-wheel low-speed electric vehicles in Shandong rose from 187,000 to 756,000 between 2014 and 2017. In 2019, 450,000 four-wheel low-speed electric vehicles were sold in Shandong province, far higher than the 119,000 micro new energy vehicles sold nationwide.

With the spread of low-speed electric vehicles, the acceptance of electric vehicles in rural areas began to increase. In the past year, acceptance of electric cars among rural residents rose 19 per cent, according to the Report on Electric Vehicle Mobility in Rural China released by the Committee of 100. If they upgrade and buy new energy vehicles, it will bring huge increase to the market.

"Small electric cars are making a big difference in the rural market." Honorary President of the China automotive engineering society pay in wu said in auto market and consumption BBS, low-speed electric car market demand, industrial chain mature, if proper policies to guide, small electric vehicles in the vast rural go a long way, and the market is infinite, the rural market should become China's new energy vehicles, especially small electric vehicles under the state of the swimmer.

"Rural development requires electrification. Electric vehicles can be both a means of transportation and a mobile power source for all kinds of modern agricultural machinery." Wang Binggang, head of the National New Energy Vehicle Innovation Engineering expert group, said electric vehicles have advantages that fuel vehicles do not, and can even become one of the technological ways to electrify rural areas.

For the rural market, price is still the core competitiveness. Mr Fu says the rural car market needs "cheap and electric" cars. "50, 000 yuan is the ceiling and the product [price] should not exceed 50, 000 yuan".

Source: Automotive Market and Consumer Forum

Zhang Yongwei, vice President and secretary general of the China Association of 100 Electric Vehicles (ACEVAC), said the survey results show that rural residents' demands for electric vehicles have three elements: one is to meet their living and production needs at the same time; the other is to sell electric vehicles for less than 50,000 yuan; and the third is to have a basic range of more than 200 kilometers.

The Study on The Mobility of Electric Vehicles in Rural China predicts that by 2030, the number of electric vehicles in rural areas could reach 9.75 million, 20.7 million and 41.88 million under baseline, subradical and radical scenarios, respectively.

"Go to the countryside" is not only to lower the price threshold

The sinking market has become a hot spot for new energy vehicle companies to cluster together, but rural areas are not readily available new lands.

Different from urban areas, limited by construction costs, charging infrastructure operators have no strong driving force to deploy DC quick charging piles in rural areas, resulting in serious insufficiency of infrastructure supporting facilities in rural areas. Moreover, the after-sales service system in rural areas is not perfect, and the maintenance convenience of electric vehicles is poor. Although automobile enterprises have begun to pay attention to the rural market, most of their sales channels have not yet sunk into counties or villages, which has a great impact on the bulk commodity of automobiles.

This is also why four-wheel low-speed electric vehicles, which do not need to be licensed and are easy to charge, will be popular in Shandong, Henan and other regions.

Source: Automotive Market and Consumer Forum

On the other hand, there is still a shortage of new energy vehicles in rural areas. Zhang Yongwei said that the current supply side development to meet the rural market is not in place, about 50 thousand yuan few models, a large number of models priced at 100 thousand yuan or more, mainly for urban demand.

The travel in rural China electric vehicle research report pointed out that at present, the electric car mileage, charging speed, power and other performance has reached the rural consumer expectations, but due to the relative fuel prices less competitive, selection of mainly low-speed electric cars and some low configuration product, rural residents choose to electric power and is not enough, the difference between supply-side and demand-side about 20000 yuan.

In addition, compared with first - and second-tier cities, third - and fourth-tier and sinking markets require more financial solutions. But financial schemes in areas below the county level have been scarce, and the penetration of credit CARDS is low, making it more difficult for new energy vehicles to land in the countryside.

Due to the low penetration rate of electrification in the rural automobile market, it is difficult to form scale effect, and enterprises have poor power to make overall layout in the rural market, with certain hysteresis, premature layout and even loss risk.

"Rural areas have not experienced the electrification of taxis and buses, and a lot of the demand for electrification has not really been tapped." Lin Mi, CEO of Yundu New Energy, said after visiting rural areas for a month that low-speed electric vehicles such as Laoluolle mostly meet the needs of the declining market, and the demand of young people as the main consumer force remains to be explored.

In Lin Mi's view, the new energy vehicle in the rural market promotion mode is still in the exploratory stage.

Ling told ID: Auto-Time that "going to the countryside" for new energy vehicles is not just about lowering the price threshold. Cities are the leaders in automobile consumption, and only after a certain degree of urban development will they transition to rural areas.

Can the liuzhou model be replicated?

Compared with the hot policy, the new energy vehicle in the rural market began to appear some cold. There is still a lot of work to do to reach the ten-million-car market target.

"Bringing new energy vehicles to the countryside is just a driving force." Ma Chunsheng, head of the automotive development department at the First Equipment industry Division of the Ministry of Industry and Information Technology (MIIT), said local governments should issue supportive policies, strengthen product research and development and explore business models, and gradually improve the after-sales service system to better promote electric vehicles in small and medium-sized cities and rural areas.

Source: Automotive Market and Consumer Forum

Both Ma chunsheng and Wang Binggang believe that the "Liuzhou model" is worth learning.

Since Liuzhou officially launched the promotion mode of new energy vehicles in January 2018, the accumulatively sales volume of micro-electric vehicles in this city of 3 million people has reached 65,000, with an average of 2 cars per 100 people.

"Liuzhou model" of a key, is from the aspects of policy support, use the link give preferential, including parking, charging infrastructure and there is no limit line policy, etc., the local government also should do some propaganda work, let more rural residents learn about the electric steam, create favorable electric cars in small and medium-sized urban and rural areas to promote the use of favorable conditions.

When in Rome, the introduction of local measures is also a key part of the promotion of new energy vehicles in rural areas.

According to the Report on Electric Vehicle Mobility in Rural Areas of China, rural areas in different cities and within cities vary greatly. The jiangsu, Zhejiang and Shanghai areas, the Yangtze River Delta, and the Pearl River Delta have relatively high levels of rural development, and their demand for products is not the same as that in western regions and less developed areas. In the process of electric development, different development routes should be formulated according to local conditions.

In less developed areas, sinking products and low-speed electric vehicles are introduced into the rural market, and then electric travel is developed mainly through product diversification. In the rural market of developed regions, electric transportation has entered the mature market stage, and consumers have a high acceptance, so the infrastructure construction needs to make greater progress.

In addition, According to Fu, there is also a need for a clear classification of micro-electric vehicles, including their size, speed and range, making it "urgent" to develop a standard.

"When we talk about rural markets at the moment, we over-visualize rural residents." Lin said there are many types of customer portraits in the rural market and a variety of consumer groups in rural areas, but the mainstay of electric vehicle consumption is young people in areas below the county level. This means that even in rural markets, the trend of intelligent development cannot be ignored.

Wang believes that car companies should give priority to developing and producing "national electric vehicles" suitable for small and medium-sized cities and rural areas. Infrastructure operators should also strengthen promotion in small and medium-sized cities and actively cooperate with new energy vehicles to the countryside.

"China has a huge market, which has not only room for luxury cars, but also a vast space for small electric cars and new energy vehicles." 'After this round of structural adjustment in China's auto market, small electric vehicles will develop into a new industry with great vitality in the national

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!