Scan QRCode

On the eve of the launch of China's electric car market, international auto companies are urgently stockpiling "grain", their interest in power batteries, has never been so hungry.

Honda recently decided to buy a stake of 1 percent in Ningde Times for 3.7 billion yuan, following the 56GWh cooperation order sealed in February last year.

Daimler has just paid 900 million yuan for a 3 percent stake in Forenix, which signed a long-term battery supply order in 2018. Earlier in May, Volkswagen paid 9 billion yuan to become the largest shareholder in Guoxuan Tech, becoming the first international car company to control a Chinese battery company.

As you can see, international auto companies' requirements for power batteries are no longer limited to supply relations. To further consolidate their cooperation through strategic capital investment or even acquisition, so as to ensure stable supply in the future, has become the choice of more and more auto companies.

At the same time, it seems urgent to establish a more diversified battery supply chain beyond the core suppliers.

After identifying Ningde Times as the "one supplier", international auto companies launched a wide range of "screening" in China last year, hoping to find more supporting enterprises among local Battery companies in China.

The latest market news is that Wanxiang 1223 has become the third POWER battery supplier cooperated by Volkswagen in China. Yiwei Lithium Energy has obtained the designated letter from BMW Brilliance battery supplier. Nissan and Xinwangda will jointly develop e-Power-based vehicle battery.

Meanwhile, domestic battery companies including AVIC Lithium And Prospect AESC have also disclosed to GAC lithium that they are in close contact with a number of international auto companies.

Behind this flurry of supply chain stockpiling, the message cannot be ignored: global carmakers are on the verge of an electric storm in the Chinese market.

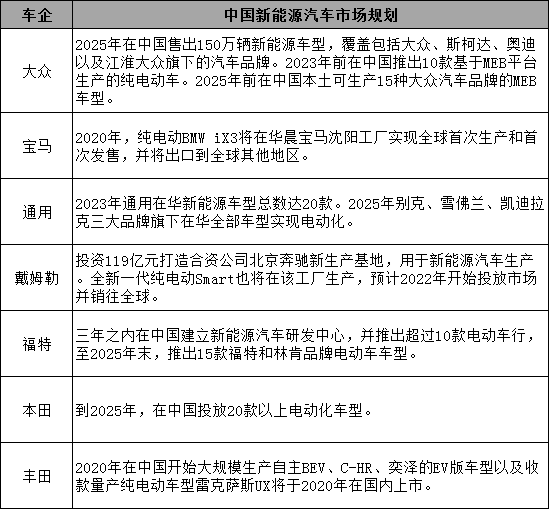

At the current pace, 2021-2023 will usher in a period of intensive introduction of electric models by foreign-funded automobile enterprises. According to the unanimous research and judgment of the industry, China will usher in a turning point in the comprehensive electric market in 2023 after that, and the market will enter a period of rapid development and growth in 2025.

In fact, in the process of China's electrification in the past few years, domestic automobile enterprises (self-owned brands, new power automobile enterprises) played the leading role. Although foreign automobile enterprises also participated in the process, their overall performance could only be regarded as "work without effort", and no truly competitive electric models were introduced to the market.

After 2020, marked by the production of Tesla's Shanghai factory and the dust-free performance of Model3 in the Chinese market, more foreign auto companies are rushing to make their pure electric models.

In July, the DEBUT of THE BMW iX3, its flagship model in the pure electric field, will be produced at BMW Brilliance's Tiexi factory in Shenyang and exported globally. The ID.4, vw's first MEB platform model in China, will also be unveiled in the coming October.

In addition, the main models based on a series of pure electric platforms, such as Mercedes-benz EVA platform, General BEV3 platform and Hyundai E-GMP platform, have been ready to enter the Chinese market.

International carmakers are excited by the scale of their electric ambitions, the density of models and the looming inflection point in the market, and nervous about their supply chains.

Volkswagen alone, for example, plans to have 1 million MEB electric cars in China by 2025.

According to feng sihan, CEO of Volkswagen China, with the current plan, Volkswagen's battery demand in the Chinese market will increase to 150GWh per year starting from 2025.

Demand for power batteries from Daimler, BMW, Toyota, Nissan, Honda and Hyundai is also strong.

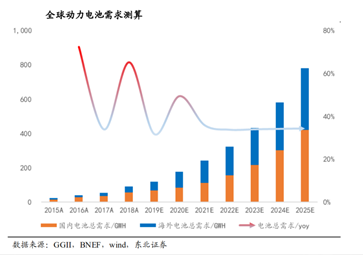

According to GGII data, the demand for power batteries in The Chinese market is expected to reach 256GWh by 2023 and 431GWh by 2025.

In the past few years, major international auto companies have identified at least one core power battery supplier in China. However, according to the current plan, once multiple models are launched at the same time, the battery supply is likely to be "insufficient".

The most serious and urgent problems facing these foreign monks are the huge gap in production capacity, insufficient production capacity of vehicle standard batteries and the number of enterprises with supply capacity.

This is the reason for the recent moves to deepen capital ties with head companies that have already secured supply relationships, and to further extend the reach of Chinese battery suppliers seeking to diversify.

The industry must face up to the fact that this arrangement of international auto companies in China's power battery field will have a profound impact on the market competition situation in the next few years.

Gao Gong Li Power believes that after 2020, Chinese power battery enterprises will not only play a key role in the supply chain system of the Chinese market of international automobile enterprises, but also further expand into a broader international market through the globalization strategy of these automobile enterprises based on the Chinese market.

First, unlike the last round of battery supply selection by international auto companies in China, which was biased towards Japan and South Korea, the selection of suppliers in this round is focused on Chinese battery suppliers.

This is partly due to the consideration of avoiding policy risks, but the more important reason is that Chinese power battery enterprises have been able to meet the requirements of international automobile enterprises in terms of technological product strength, manufacturing capacity, supply chain management capacity, cost competitiveness and so on, and have demonstrated alienated competitiveness with Japanese and Korean rivals.

This is reflected not only in the first two giants of Ningde Times and BYD, but also reflected in the second echelon enterprises of Guoxuan High-tech, AviC Lithium, Yiwei Lithium energy and Wanxiang no.1, No.2 and No.3. This process of technological iteration and manufacturing improvement brought by market verification is not available to Japanese and Korean rivals.

In terms of product diversification, Chinese battery companies show their differentiated competitiveness with their Japanese and Korean rivals. LFP battery from Tesla and Volkswagen designated LFP battery from Guoxin Technology Co., Ltd. of Ningde Times are all differentiated competitiveness formed by Chinese enterprises based on changes in local market demand and combined with their own technological advantages. In terms of the high-nickel system, the 811 battery of Ningde Times has been matched with THE BMW iX3, which is also ahead of its rivals.

In addition, In the industrial and value chains, Chinese companies are also significantly better. China's lithium battery industry chain has occupied more than 70% of the global market share. A large number of supply chain supporting enterprises with international capability have been formed around China's head battery enterprises, which is also a consideration factor for international automobile enterprises to choose Chinese battery enterprises.

Second, The global leading position of Ningde Era will be further consolidated, and the cooperation with international automobile enterprises will be more deeply bound. In this round of cooperation with automobile enterprises, Ningde Times not only gets the capital intervention of automobile enterprises, but also the cooperation scope of supply chain is no longer limited to the Chinese market.

According to the public information, the cooperation between Tesla, BMW and Honda, as well as the procurement demand of Ningde Times, has not been limited to supporting the domestic market, but has clearly proposed to export to the foreign market. This, in turn, will accelerate the pace of globalization in the Ningde era in the coming years. It is also certain to further secure its position as a global leader.

Third, after the international automotive enterprises or orders, including Guoxuan High-tech, Yiwei Lithium energy, Wanxiang One two three, Xinwangda, Funeng and a number of second echelon battery enterprises will be rapidly expanded, so as to have the resistance and immunity in the face of market risks.

At the same time, from the perspective of the supply chain demand of international automobile enterprises, there will still be a group of Chinese power battery enterprises with the technical strength of vehicle grade products and international vision to enter their range of choice.

Kgli learned that aviC Lithium, Vision AESC, Hive Energy, LISHen, Tafel and other companies are also in close contact with international auto companies.

From the perspective of electric vehicle market competition, the model proportion of foreign auto companies will remain a very important segment in the future Chinese market, while Chinese battery companies will benefit from their demand if they enter their supply chain.

But at the same time, getting international customers means that they need to make further improvements in capacity layout, manufacturing capacity, cost control, technological iteration, supply chain and other links, as well as be ready for capital level.

In addition, the risks brought by supporting international auto enterprises cannot be ignored. Once there is a sudden explosion in product safety and production capacity supply, it will face the risk of falling behind or even being eliminated.

AMS2024 Exhibition Guide | Comprehensive Exhibition Guide, Don't Miss the Exciting Events Online and Offline

Notice on Holding the Rui'an Promotion Conference for the 2025 China (Rui'an) International Automobile and Motorcycle Parts Exhibition

On September 5th, we invite you to join us at the Wenzhou Auto Parts Exhibition on a journey to trace the origin of the Auto Parts City, as per the invitation from the purchaser!

Hot Booking | AAPEX 2024- Professional Exhibition Channel for Entering the North American Auto Parts Market

The wind is just right, Qianchuan Hui! Looking forward to working with you at the 2024 Wenzhou Auto Parts Exhibition and composing a new chapter!

Live up to Shaohua | Wenzhou Auto Parts Exhibition, these wonderful moments are worth remembering!

Free support line!

Email Support!

Working Days/Hours!